| Title | Description | Date |

|---|---|---|

|

This document describes the specifications and details related to the Accounts

|

25/03/2025

|

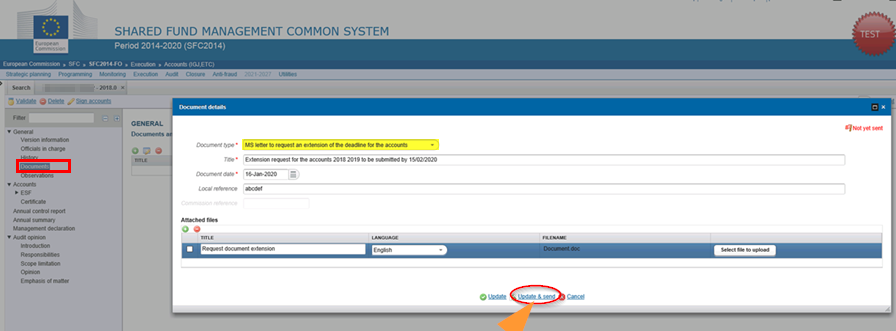

ACC - Documents

The document has to be uploaded as a "MS Letter to request an extension of the deadline" in the Documents section of the Accounts.

For this you need to create the Accounts dossier for the given accounting year first!

You can refer to the instructions in section Create accounts and in section Documents of the quick guides IGJ ETC , IPACB , EMFF , FEAD , AMIF ISF , EAFRD EAGF .

→ read more

The removal of the option to send the 'Other Member State Document' type in the Accounts was requested by DG EMPL & DG MARE and implemented in October 2016.

Information should be included in the Accounts as Structured data and with the integral/non-integral documents when needed.

The option of the 'Other MS Document' is still in the menu because one must be able to select the already existing 'Other MS Documents', but it will no longer be possible to send new ones.

→ read more

ACC - General

Yes, the Accounts should be submitted (with zero expenditure), a disclaimer of opinion can be issued (in section Audit opinion > Opinion).

The updated guidance note "Guidance for Member States on the Annual Control Report and Audit Opinion to be reported by audit authorities and on the treatment of errors detected by audit authorities in view of establishing and reporting reliable total residual error rates (EGESIF_15-0002-04)" is published on Inforegio(*) under Management and Control and clarifies that:

(refer to page 37)

Disclaimer of opinion in case no expenditure is declared to the Commission during the accounting year:

In case no expenditure has been declared to the Commission in regard to the accounting year and the CA reports no amount of programme contributions paid to financial instruments under Article 41(1) CPR or advances of State aid under Article 131(4) CPR in the accounts, a disclaimer of opinion (covering all 3 elements of the opinion) is deemed appropriate.

This applies even though the AA may have already carried out some system audits. Results of these audits are to be reported under section 4 of the ACR. However, as no amounts have been certified in the accounts, a disclaimer of opinion (due to the accounts and L/R) is deemed appropriate.

→ read more

Yes, unless no expenses are declared in Appendix 1 and Appendix 7 of the Accounts.

When creating the Accounts the system automatically copies the amounts in Appendix 1 and Appendix 7 from the Final Payment Application for the Accounting year.

If the Final Payment Application has not been submitted in SFC2014, the same amounts that would be declared in the Final Payment Application should be entered in Appendix 1 and Appendix 7.

When validating the Accounts the system verifies the amounts in Appendix 1 and in Appendix 7 against the amounts in the Final Payment Application (if it exists).

In the case the Final Payment Application has not been submitted the system will verify the amounts against ' 0 ' and will generate an error message if the amounts do not correspond.

This is checked by the following validation rules:

2.34 validate in the appendix 1 of the Accounts that the amount in column "Total amount of eligible expenditure entered into the accounting systems of the certifying authority and which has been included in the payment applications submitted to the Commission" (AccountsExpenditure.totalExpenditureAmount) is not higher than the amount in Column "Total amount of eligible expenditures incurred by beneficiaries and paid in implementing operations” (PaymentApplicationExpenditure.totalExpenditureAmount) of the corresponding last sent or accepted version at EC level of the Final Payment Application of the same Accounting Period (if exists) (error)

2.35 validate in the appendix 1 of the Accounts that the amount in column “Total amount of the corresponding public expenditure incurred in implementing operations" (AccountsExpenditure.publicExpenditureAmount) is not higher than the amount in Column "Total amount of public expenditure incurred in implementing operations" (PaymentApplicationExpenditure.publicExpenditureAmount) of the last sent or accepted version at EC level of the Final…

→ read more

The name of the authorities are copied automatically from the Designation of Authorities in SFC2014 and should be maintained in the Designation of Authorities dossier.

However we have enabled, for this year (version 2018), the editing of the field "name of the person on charge of the authority" in the Accounts module in SFC2014.

→ read more

The Accounts contains 5 main elements: Accounts, Management Declaration, Audit Opinion, Annual Summary Document and a reference to an Annual Control Report version. When the Commission changes the status of the Accounts (after it has been sent by the Member State) they can choose which of the 5 elements can be modified in future Accounts versions for the same Accounting Year. This choice determines which of the 5 elements will have Edit icons in version +1.

Firstly, verify that you have update access as the correct Authority for the corresponding element. You can request this to your SFC2014 Liaison Officer. If you do not know who your Liaison officer is please contact the support team via the 'Support Contact' menu on he portal.

If your access rights are correct and you need to modify one of these elements in a later version of the Accounts then you should contact your desk officer at the Commission (the Accounts must be in one of the following status: 'Returned for modification by EC (Incomplete submission)', 'Returned for correction by EC (Immaterial or clerical errors)', 'Returned by EC for actions to be taken by MS', 'Accepted by EC', 'Accepted by EC with follow-up' or 'EC unable to accept accounts (Decision adopted)') and request that they change the choice of elements to be modified.

→ read more

It is normal that the status 'Under Examination' will remain during the early stages following the deadline for the Accounts, either until the Commission replies to the Member State with a Final Evaluation on the Accounts (Acceptance or Non-Acceptance), or unless the Commission requests technical corrections from the Member State (Returned for Correction (Immaterial or Clerical errors)).

→ read more

ACC - Accounts

Yo have to do 2 different things:

1/ Create a new version of the ACR under the Audit tab and update it as needed in SFC2014, then send it again to the Commission.

2/ Create a new version of the Assurance package in the Accounts module in SFC2014. Update the link of the ACR with the new version and send it to the Commission.

→ read more

Which amount should I enter in the table?

- the amount entered in the last payment application?

- the amount paid to beneficiaries? (because of overpayment A > B)

The same amounts as you would declare in the payment applications. If a final payment application for that accounting year was submitted the system will automatically take its amounts. When no final payment was submitted the most recent amounts for that accounting year as if it was a final payment application declaration has to be entered.

For the amounts submitted in the 17-18 and 18-19 accounting year the system did not prevent submiting a higher amount in the column C in relation to the column of Total and Public expenditure (validation rule 2.47 was added later).

The amount of the payment to beneficiaries is linked to the amount of the expenditure declared in the final payment claim at the latest the 31/07 of the year N. If payments to beneficiaries continue before the submission of the accounts in the year N+1 but in relation to the amount of the expenditure declared in the final payment claim therefore the amount to be declared in the column C cannot be higher than the amount of Total/Public expenditure.

The amount of the Total/Public expenditure should be the amount of eligible expenditure in payment claim forming the basis for each payment to the beneficiary.

This column C is only used for reporting purposes and not for the calculation of the balance of the accounts.

…

→ read more

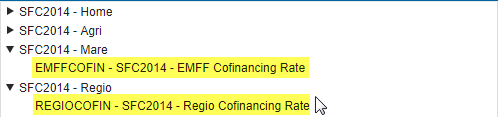

ACC - Cofinancing Rate

To help National Authorities assessing total eligible expenditure and national funding for an Operational Programme in case of an increase in co-financing rates, a new report called 'Cofinancing Rate' has been developed indicating the new minimum national funding for reaching the maximum EU funding adopted in the decision on the OP.

For additional information on how to generate such report using SFC2014, follow this link to the quick guide: https://ec.europa.eu/node/quick_guide/2762

You can find this report under the funds of MARE & REGIO:

For more details about the 'Cofinancing Rate' in case of an increase, please click on the link - - Read more - -

.

.

IT development illustrating the impact of an increase in co-financing rates on total expenditure and national funding

1. A programme modification may affect the European Union co-financing rate. The new rate is applicable, for payment applications introduced by national authorities in SFC, only after notification from the Commission that the modifying decision has been adopted.

The introduction of the annual accounts changes the declaration of eligible expenditure. Eligible expenditure is now declared cumulatively over the current accounting year and not over the entire programming period. For each accounting year, the amount chargeable to the Fund is determined by the accepted annual accounts.

As already described in the Guidance note on the preparation, examination and acceptance of accounts*, any agreed changes in the co-financing rate applies only to the current and future accounting years. The change is applied to the first payment application submitted following the adoption…

→ read more

ACC - Audit opinion

The Audit Authorities have to enter the OPINION in the Accounts and not in the Annual Control Report.

This is communicated to the MS Audit Authorities with the guidelines.

→ read more

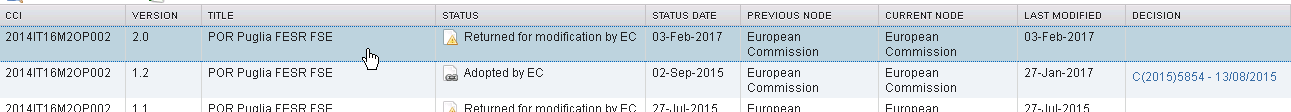

When an object is returned by the Commission in SFC2014 it will display as 'Current node' -> 'European Commission'. This is because the version that has been returned is no longer editable by the Member state and they must create a new version of the object in order to edit the information.

→ read more

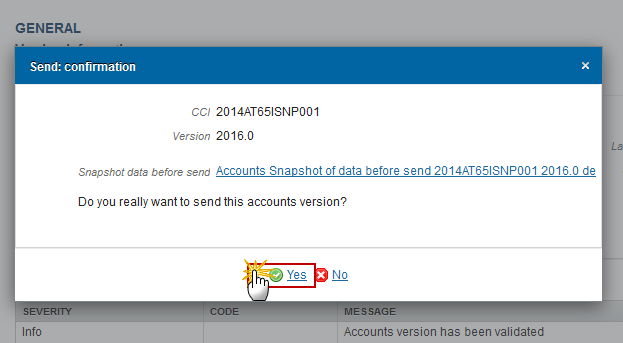

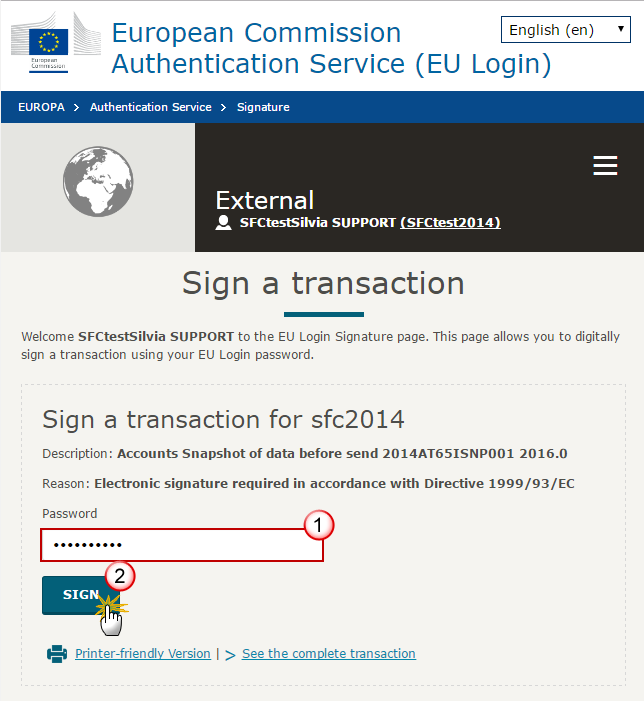

The Sending of information by a Member State to the Commission should be electronically signed in accordance with Directive 1999/93/EC.

Sending of the different objects is generating a snapshot document and after the sending an acknowledge

document is generated by the European Commission.

This acknowledge document is signed but the Member State was not signing the snapshot document. The EU Login now provides a functionality of signing without forcing the user to have a certificate. The action to sign will only be triggered when sending to the European Commission:

(1) Enter your SFC2014 Password

(2) Click on the 'Sign' button

The Signature is…

→ read more

- When data is sent to the Commission, the sender receives an automatic notification from SFC2014

- On the search screen list of Programmes, Payment Applications etc, and in the 'General' section of the object under 'version information', check that the "current node" column is "Commission" and the "status" is "sent".

- In each object (excluding Standalone/referring documents) a snapshot document is added to the 'associated documents' section of the object.

- For single documents, check that the "sent date" is not empty.

→ read more

- The Object has been sent to the Commission already which means you cannot delete it anymore.

- The Object has not been sent to the Commission yet but it contains a document of type 'Other MS document' which has already been sent to the Commission. In this case you cannot delete the Object anymore.

An Object can only be deleted if:

1) its status is 'Open', 'Validated', 'Ready to send' or 'Returned for modification by MS';

and

2) it has never been sent to the Commission before;

and

3) it has no sent documents attached.

→ read more

SFC2014 enforces the "four-eyes" principle, which means that the user who last validated the Object cannot submit it. Two different users are required; one to validate and another to send.

According to Article 3(2) of Commission Implementing Regulation (EU) No 184/2014, “any transmission of information to the Commission shall be verified and submitted by a person other than the person who entered the data for that transmission. This separation of tasks shall be supported by SFC2014 or by Member State’s management and control information systems connected automatically with SFC2014.”

→ read more

The text boxes provided in SFC2014 follow the official templates. The limits are defined by the Commission implementing act and cannot be extended.

You can provide additional information in other documents which may help the Commission in its assessment of the programme by adding an 'Other Member State document' type in the document section. However, according to article 2(2) of Commission implementing regulation 184/2014 you cannot make references to this in the programme and the additional information will not form part of the programme covered by the Commission decision.

Article 2

Content of electronic data exchange system

1. The electronic data exchange system (hereinafter referred to as ‘SFC2014’) shall contain at least information specified in the models, formats and templates established in accordance with Regulation (EU) No 1303/2013, Regulation (EU) No 1299/2013, Regulation (EU) No 1305/2013 of the European Parliament and of the Council ( 3 ) and the future Union legal act establishing the conditions for the financial support for maritime and fisheries policy for the programming period 2014-2020 (the ‘EMFF Regulation’).

2. The information provided in the electronic forms embedded in SFC2014 (hereinafter referred to as ‘structured data’) may not be replaced by non-structured data, including the use of hyperlinks or other types of non-structured data such as attachment of documents or images. Where a Member State transmits the same information in the form of structured data and non-structured data, the structured data shall be used in case of inconsistencies.

→ read more

The size limit per file is 500MB.

There is no limit on the number of files or the total size of all files in an object.

The following file extensions are allowed:

“.7z”, “.bmp”, “.csv”, “.docx”, “.jpeg”, “.jpg”, “.msg”, “.ods”, “.odt”, “.odp”, “.odg”, “.odc”, “.odf”, “.odi”, “.odm”, “.ott”, “.ots”, “.otp”, “.otg”, “.pdf”, “.png”, “.pptx”, “.rar”, “.rtf”, “.tif”, “.tiff”, “.txt”, “.xlsb”, “.xlsx”, “.zip”, “.gif”, “.eml”

→ read more

The content of a programme can be seen by an EC user even before it is submitted to the Commission. This is to help the Member States during the amendments process.

Documents can only be consulted when they are sent. This is because documents do not have a full workflow as is the case for the structured data and their content is unknown and could contain sensible data which the Member State doesn't want the Commission to know before it is officially submitted.

Therefore, the "Other MS document" type and the "Informal Commission's Observations" document type were foreseen, so that the Member States could send whatever they want to send during the amendment process on an informal basis and the Commission could send them their observations already before the official submission.

→ read more

Unfortunately this is a problem in the Microsoft Edge browser, not in SFC2014.

The browser doesn't recognize it's a .pdf file. As a workaround you should save the file and give it the name and extension as indicated on the screen, then you will be able to open it in your downloads folder.

→ read more

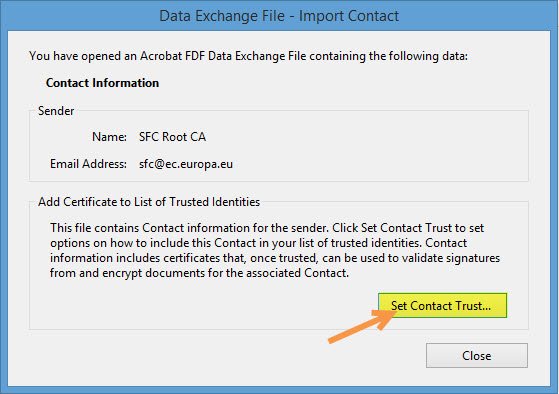

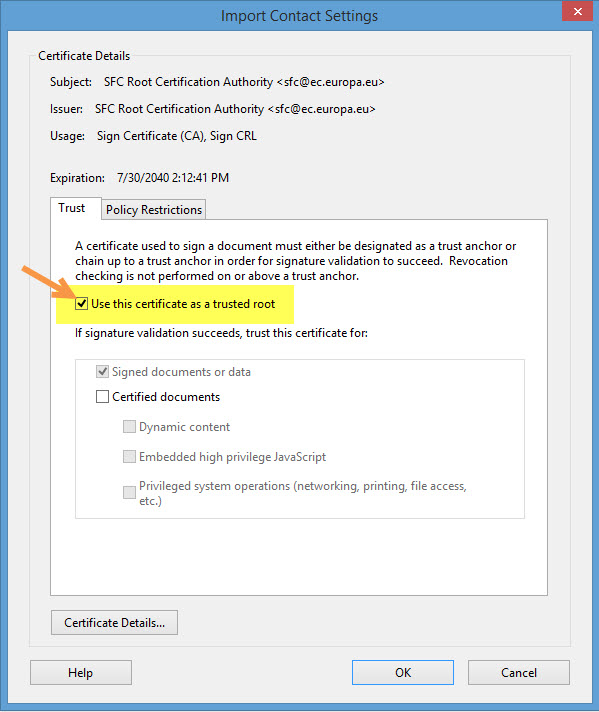

The acknowledgement of receipt is signed with an electronic certificate guaranteeing the date and time of the signature as well as the integrity of this document. The certificate used to sign this document is held by the European Commission and can be verified by the corresponding public key.

The first step to validate the signature is to install the certificate in Acrobat.

(This step is only necessary once per machine)

- First download the SFC certificate file named CertExchangeSFCRootCA.FDF.

- Decompress the zip file and store the certificate on your computer.

- Open Acrobat.

- Go to File > Open and select the certificate from your computer.

- A pop up will be displayed. Click "Set Contact Trust…":

- On the next screen specify that this is a trusted root certificate by checking the option "Use this certificate as a trusted root" and click OK.

- A confirmation message will confirm the import. Click OK and close Acrobat.

→ read more

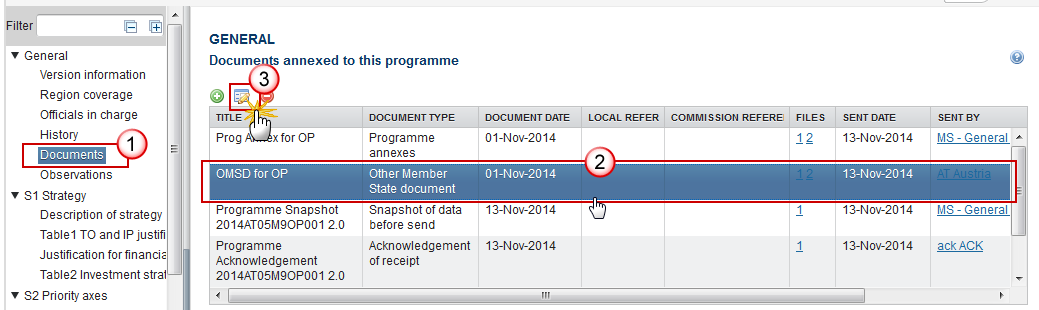

Once a document has been sent (there is a date visible in the 'sent date' column) it cannot be deleted.

However, if you are the sender of the document you may choose to 'hide' a sent document so that it is no longer visible within your programme by following the steps below:

1. In the Documents section of your OP (1) select the document from the list (2) and click the Edit button (3):

2. In the Document Details pop-up select the document you wish to hide (1)…

→ read more

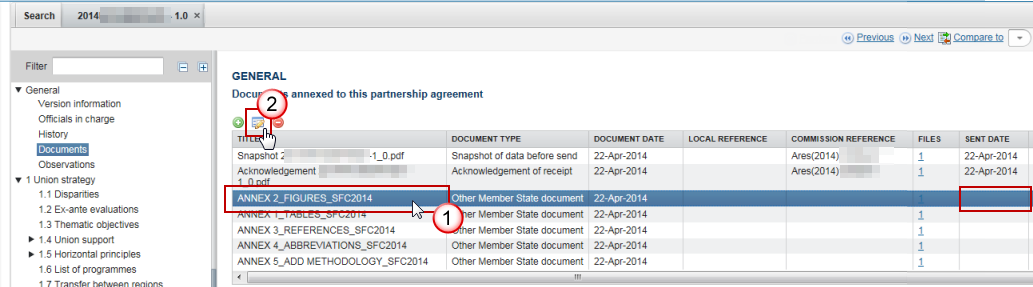

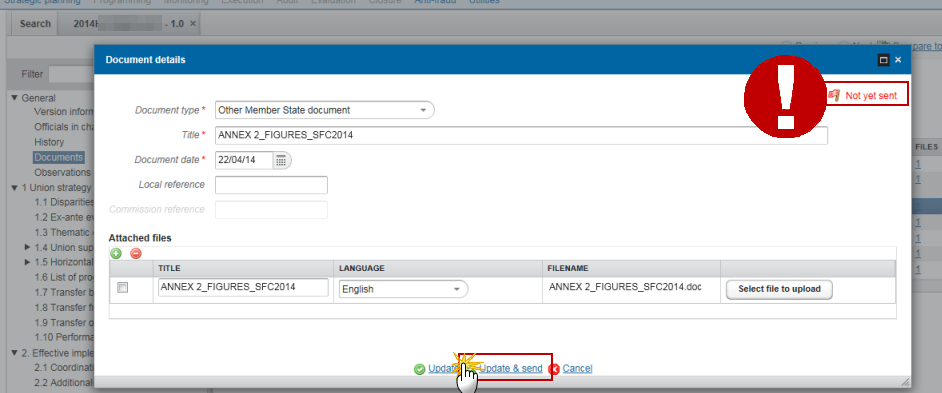

If a Commission user cannot see the other documents you uploaded, this is because these are type 'Other Member State Document' and are sent independently (as you can see below there is no 'sent date') of the Object (PA, OP, RDP IR etc.).

The following steps should be taken for each document in order for them to be sent to the EC:

Select the document to be sent (1) and click on the edit button (2):

Click on the Update &Send link to send the document to the EC:

→ read more

| Description | Document | Date |

|---|---|---|

|

Letter to MS Accounts 2nd year pre-financing Submission of accounts, management declaration, annual summary, audit opinion & annual control report for the 2nd accounting year by 15/02/2017 when no expenditure has been declared to the Commission until 31/7/2016. |

|