Declaration of Expenditure

PURPOSE

This document describes the actions related to the submission of the monthly Declaration of Expenditure for EAGF. Its purpose is to allow the Member States Paying Agency to declare the eligible expenditures to the Commission.

REGULATIONS

More detail regarding the regulation of the Declaration of Expenditure can be found in the "About SFC2021" section of the portal.

ROLES

Roles involved in the Declaration of Expenditure are:

|

MS Accredited Paying Agency (MSPA)

MS Coordination Body (MSCB) |

Consult the EAGF Declaration of Expenditure Upload the T104 XML files Consult uploaded T104 XML files Consult the XML file errors Delete the T104 XML files Validate the EAGF Declaration of Expenditure |

FUNDS

|

EAGF |

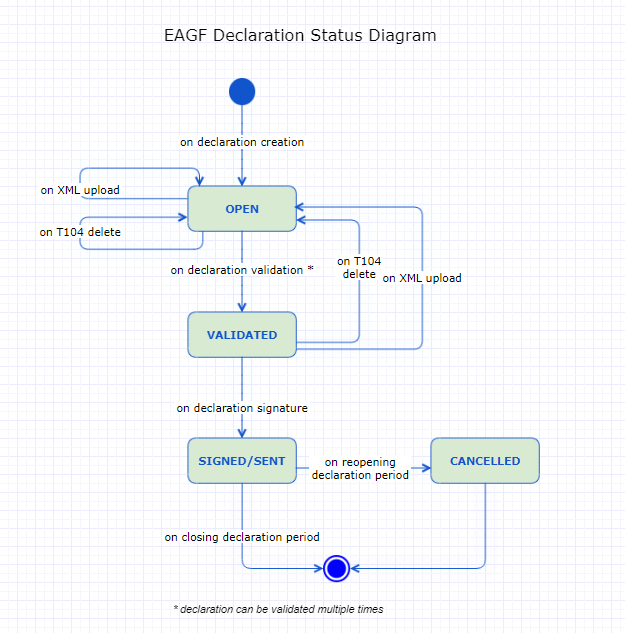

Workflow

This section shows the lifecycle to manage a Declaration of Expenditure.

Click here to see the Declaration of Expenditure workflow diagram in high resolution.

Create the Declaration of Expenditure (EAGF)

|

Remark |

When EC opens the declaration period, the Declaration of Expenditure will be created in SFC2021. |

-

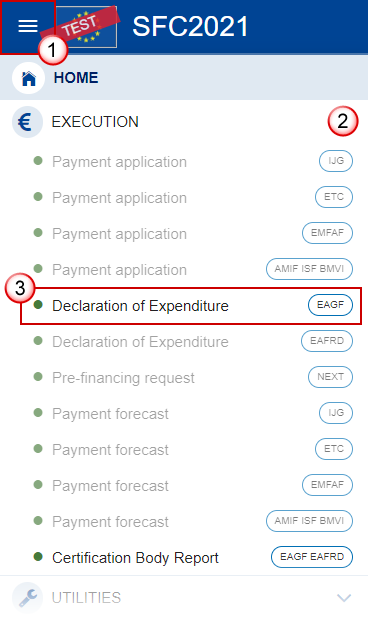

To access the Declaration of Expenditure, go to the Execution menu and select the Declaration of Expenditure (EAGF) option:

-

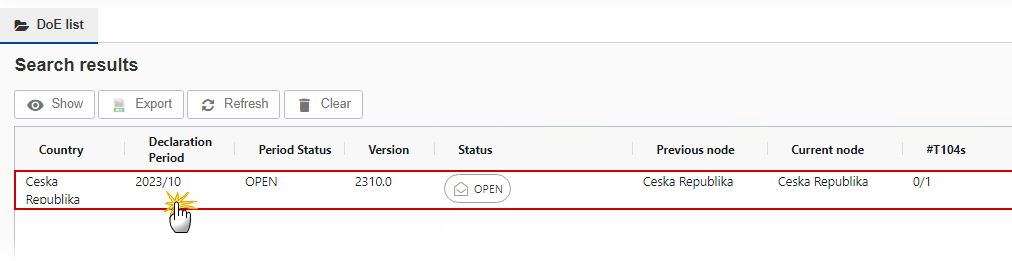

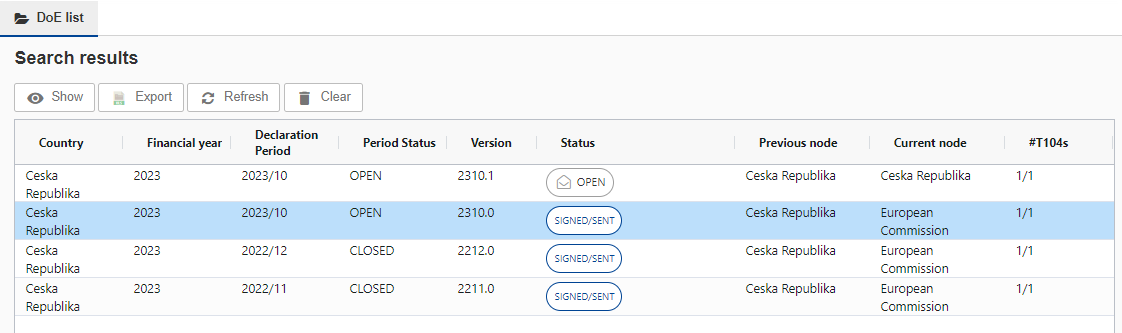

In the search screen click on the Declaration of Expenditure:

Record/Edit the Declaration of Expenditure

|

Remark |

The User is an identified User and has the role of MS Accredited Paying Agency or Coordination Body with Update rights (MSPAu/MSCBu). In order to view or edit, the User should select the line of the declaration and click on Show, or double click on the line. When editing a version of a Declaration of Expenditure, its status is Open at the level of the Member State and currently resides on the User's Node. |

General

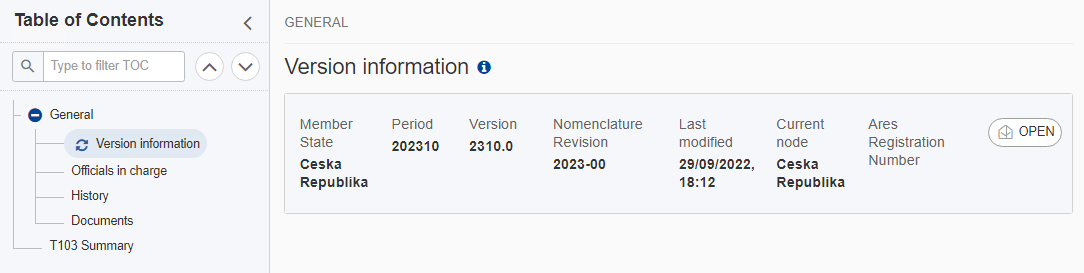

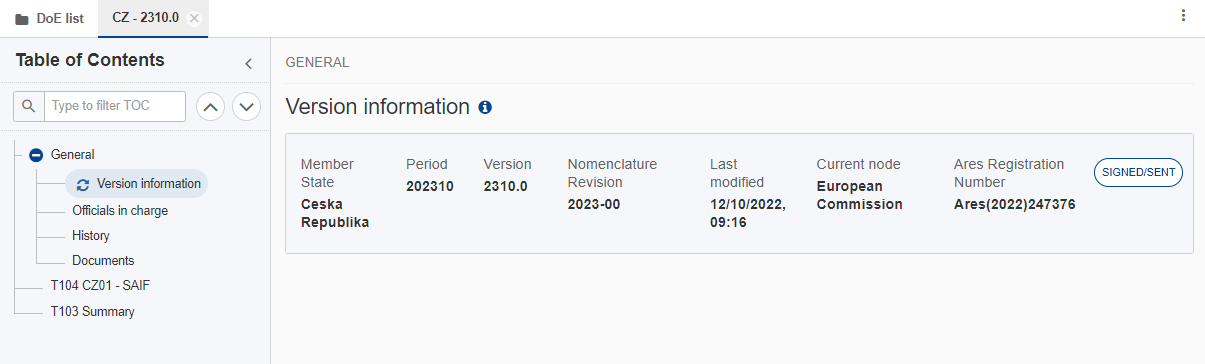

Version Information

|

Note |

The Version Information contains information on the identification and status of the Declaration of Expenditure Version like the Member State, the Declaration Period, the Version Number, the Nomenclature Revision, the Status and the Node where it currently resides. This section is not editable. |

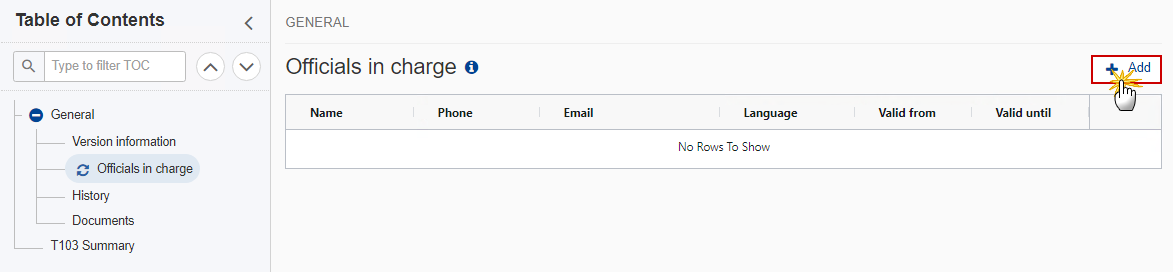

Officials in Charge

|

Note |

Officials in Charge can be updated at any time, independent from the status of the Declaration of Expenditure. Commission Officials (email domain "ec.europa.eu") can only be created/updated/deleted by Commission Users. |

-

Click on the Add button

to add a new official in charge.

to add a new official in charge. -

Clicking on the Edit icon

of a row will allow you to modify the information of this official.

of a row will allow you to modify the information of this official. -

Clicking on the Delete icon

of a row will allow you to delete the official in charge selected.

of a row will allow you to delete the official in charge selected.

-

Click on the Add button to add a new Official in Charge:

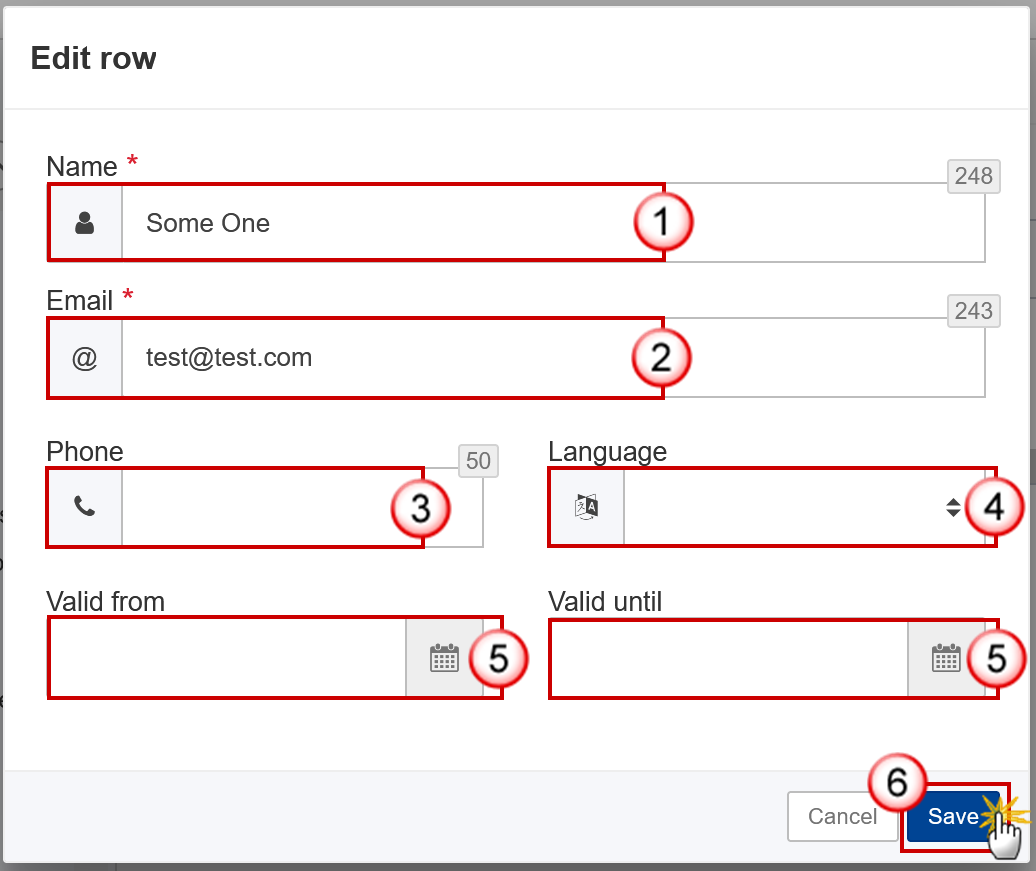

The Edit details pop-up window appears:

-

Enter or select the following information:

(1) Enter the Name.

(2) Enter the Email.

The format of the Email address will be validated by the system and should be unique.

(3) Enter the Phone number.

(4) Select the Language.

(5) Enter the Valid from and Valid until dates.

The Valid until date should be greater than the Valid from date.

(6) Click on Save to save the information.

|

Remark |

When the Declaration Period is opened, the SFC2021 system creates an empty declaration. The system will copy the officials in charge from the previous declaration. A notification will be sent to the officials in charge informing them of the new declaration. |

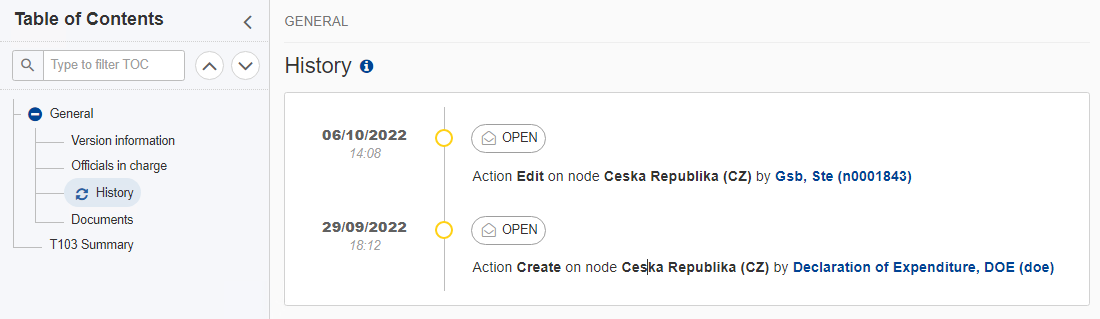

History

This section shows all the actions that have been taken on the Declaration of Expenditure since it was created, for example:

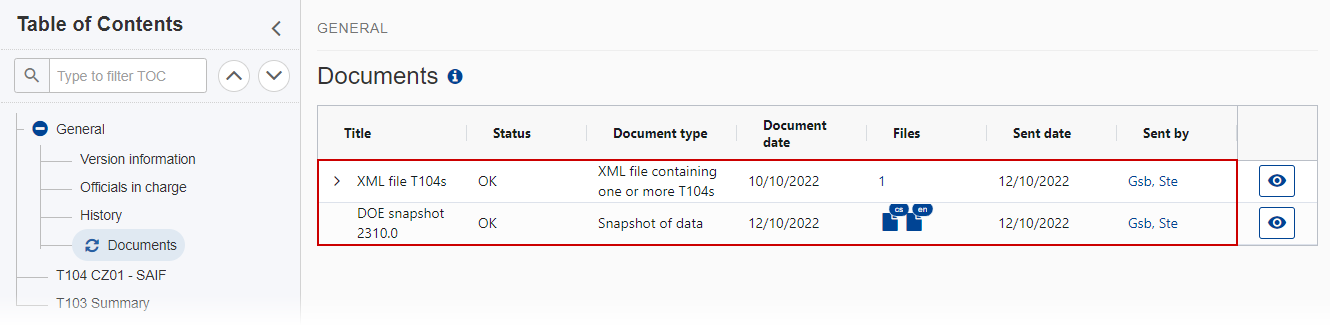

Documents

|

Note |

The Documents list shows all documents uploaded against this version of the Declaration of Expenditure by Member State and by Commission. Member State Users see all their own Documents and the sent Commission Documents. Commission Users see all their own Documents, unsent Integral Member State Documents and sent Member State Documents. |

The following documents will be foreseen:

-

XML file containing one or more T104s - XML file(s) uploaded by the User

-

Snapshot of data – Generated report – report generated automatically by the system

|

Remark |

Integral Documents like the “XML file containing one or more T104s“ are only sent - together with the encoded data – once the Declaration of Expenditure is Signed/Sent to the Commission. |

Upload a T104 file

|

Note |

The User can upload one or more T104 files to the EAGF Declaration of Expenditure. |

-

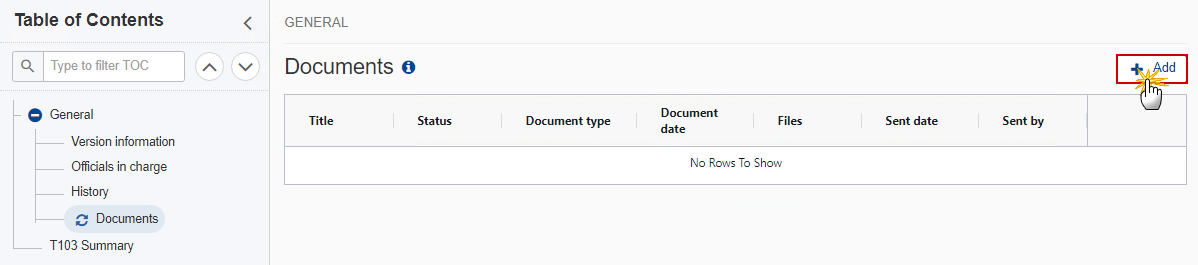

Clicking on the Add button

will open a pop-up window allowing you to add a new file.

will open a pop-up window allowing you to add a new file. -

Selecting a document row and clicking on the View icon

will allow you to view the file information.

will allow you to view the file information. -

Selecting a document row and clicking on the Edit icon

will allow you to modify the file information.

will allow you to modify the file information. -

Selecting a document row and clicking on the Delete icon

will allow you to delete the file and all attachments.

will allow you to delete the file and all attachments.

-

Click on the Add button to add a new file:

The Add row pop-up window appears:

-

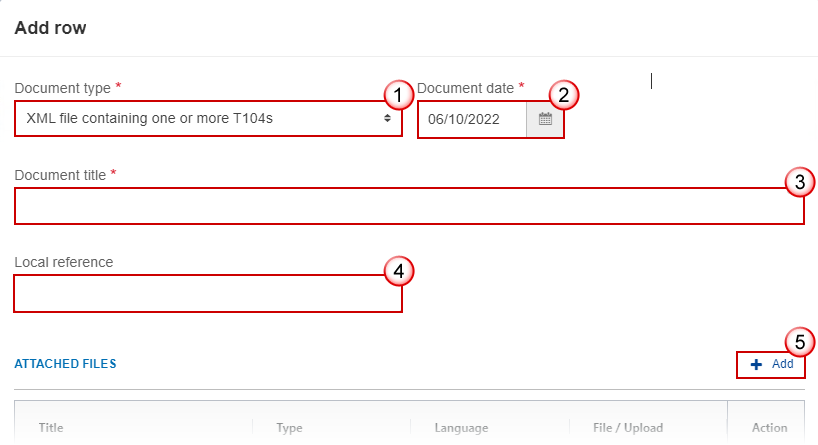

Enter or select the following information:

(1) Select the Document Type XML file containing one or more T104s.

(2) Enter a Document Date.

The system automatically fills the field with todays date, but this can be modified.

(3) Enter a Document Title for your Document.

(4) Enter a Local reference if necessary.

(5) Click on the Add button to add a new attachment:

-

You can add multiple attachments by clicking on the Add button.

-

You can remove unwanted attachments by selecting the attachment and clicking on the Delete button.

The Attached files window becomes editable:

-

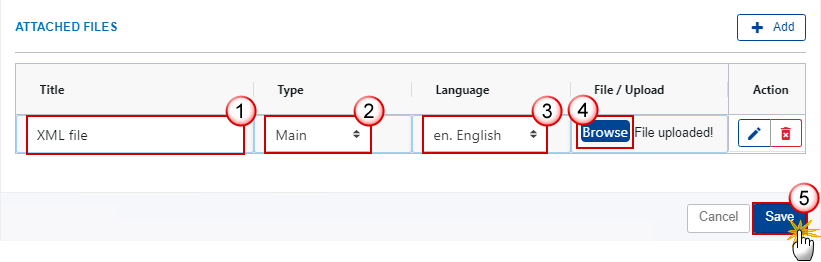

Enter or select the following information:

(1) Enter a Title for your attachment.

(2) Select the Type Main.

(3) Select the Language of the document (by default the language in the profile of the User is selected).

(4) Click on Browse to select the file that you want to add as an attachment.

(5) After the attachments are uploaded click on Save.

|

Remark |

Only XML files can be uploaded as an attachment, otherwise the system returns an error. An XML file can contain one or several T104 tables. For Member States with multiple Paying Agencies, the Users can upload either one XML file with all Paying Agencies or several XML files. A T104 table has to be submitted for each Paying Agency. When the XML file is saved, the system will verify all the declaration business rules. |

Consult an uploaded T104 file

|

Note |

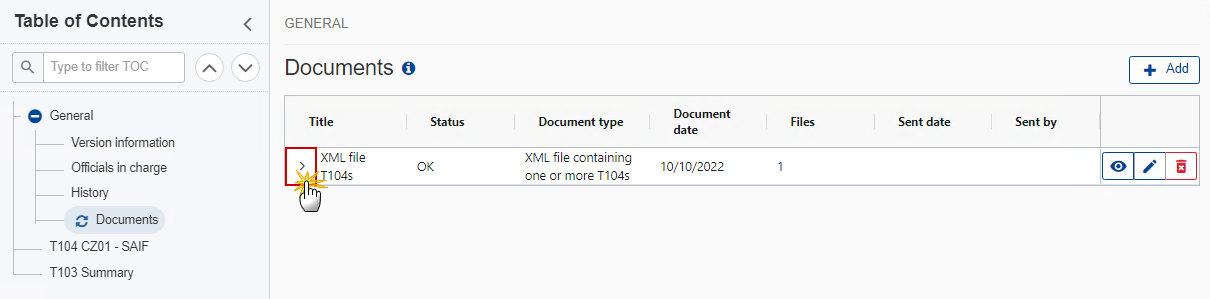

Once the T104 file is uploaded, the User can now consult its details. |

-

Click on the arrow to consult the details of the uploaded file:

The file details now appear:

-

Different actions are possible based on the File Status (OK or ERROR):

(1) View the file.

(2) View the list of Errors and Warnings detected in the file.

In case of Warnings only, the File Status will be OK.

(3) View the file with the Errors and Warnings on the corresponding lines.

(4) Delete the file. This feature is useful if a file is used for testing purposes or to delete a file with errors.

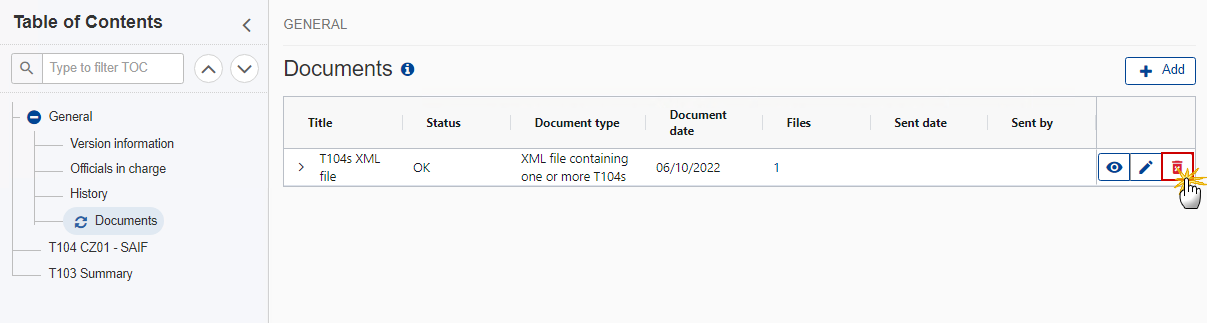

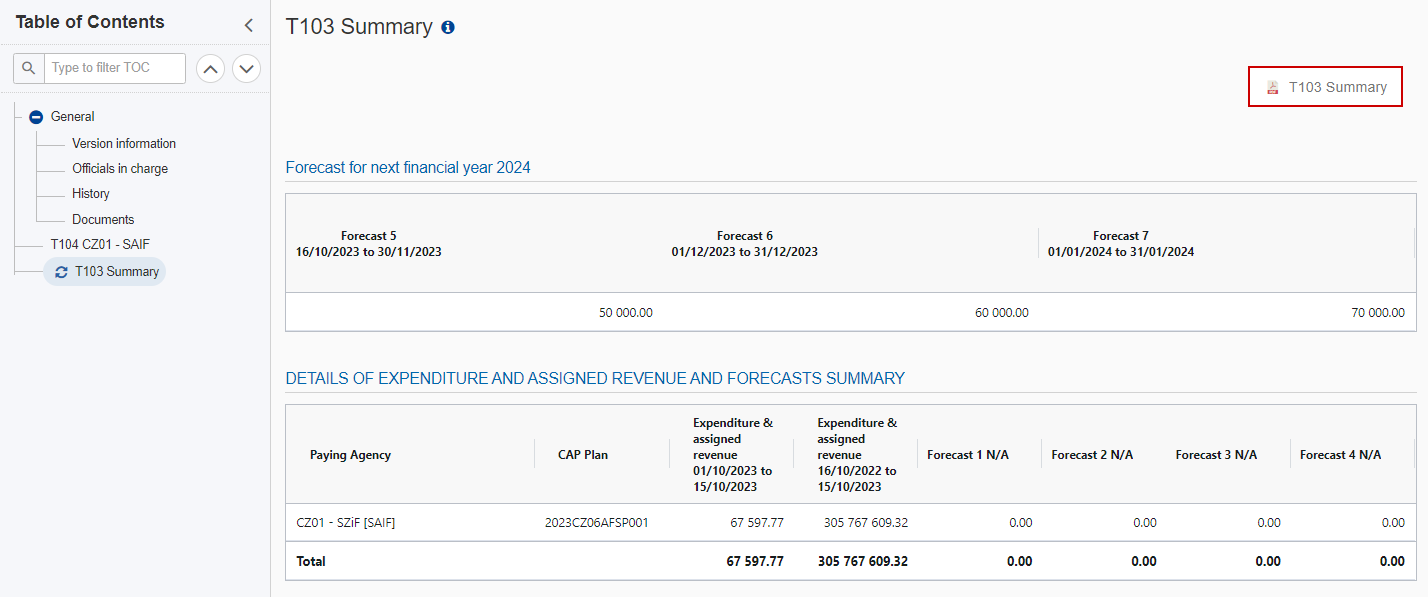

Delete the document

-

In the row of a previously uploaded document click on the Delete icon to delete the document and associated attachments:

A confirmation window appears:

-

Click on Yes to confirm deletion. Click on No to return to the document section.

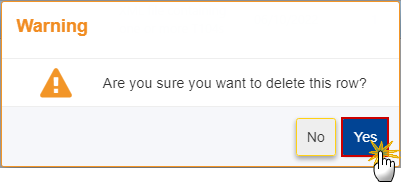

T104 <PA/CB CATS CODE> - <PA/CB Acronym>

|

Note |

This section shows the EAGF Declaration of Expenditure in details per T104 containing the calculated amounts and the budget descriptions. It will be available whenever an XML file is free of errors. The User can download the XML file and the T104 Declaration Report. |

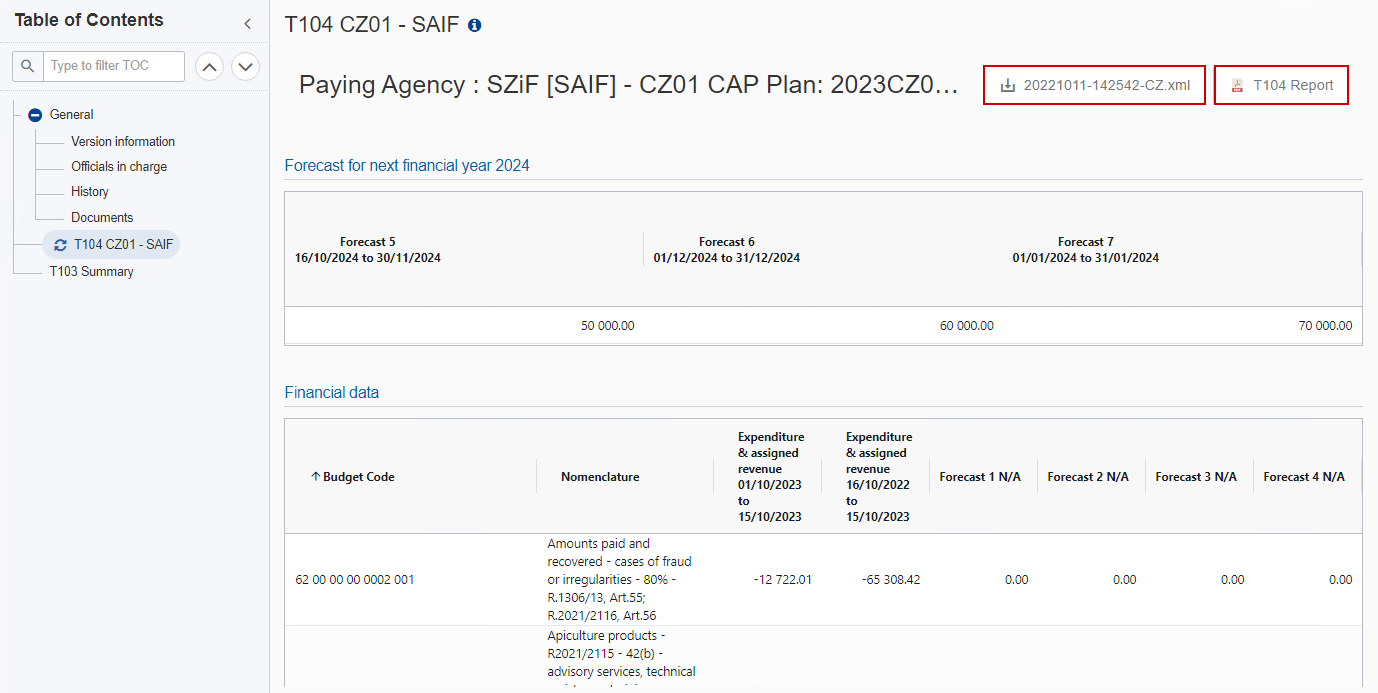

T103 Summary

|

Note |

This section is a summary table calculated from all T104s. The User can download the T103 Declaration Report. |

Validate the Declaration of Expenditure

|

Remark |

The Declaration of Expenditure can be validated after all T104s have been uploaded and when the current version is in status Open. To validate the Declaration of Expenditure, the User must have the role of MS Accredited Paying Agency or Coordination Body with Send rights (MSPAs/MSCBs). |

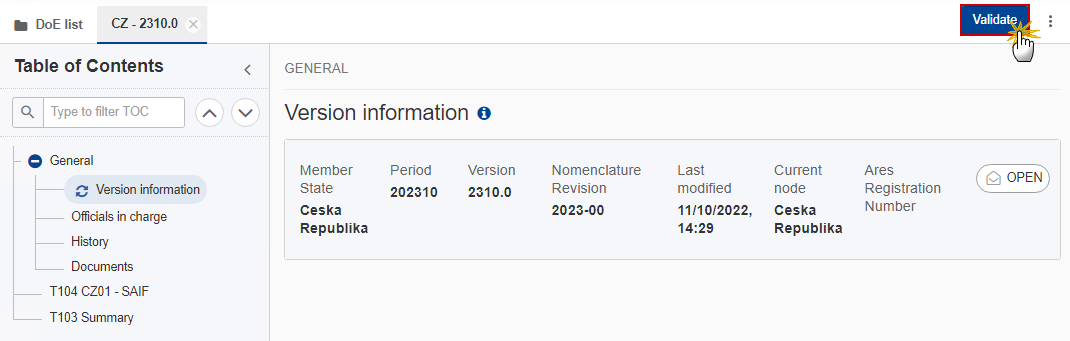

Click on the Validate button to validate the Declaration of Expenditure:

|

Remark |

An Error could block you from sending the Declaration of Expenditure. The error(s) should be resolved and the Declaration of Expenditure must be revalidated. |

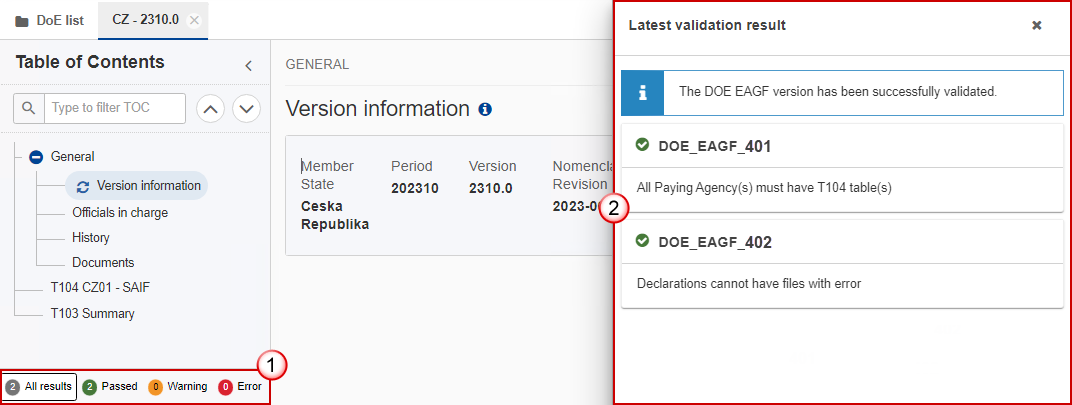

The system validates the following information:

|

Code |

Severity |

Validation Rule |

|

401 |

Error |

All Paying Agency(s) must have T104 table(s). |

|

402 |

Error |

Declarations cannot have files with error. (Any files with errors should be deleted prior to validation) |

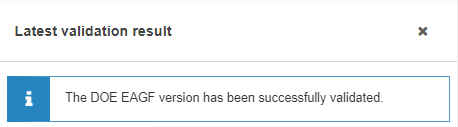

An example of a validation window:

You can check the list of validation results at any time throughout the Declaration of Expenditure:

To see the last validation results:

(1) Click on one of the 4 categories: All results, Passed, Warning, Error.

(2) The list of latest validation results for the chosen category is displayed.

After all errors have been resolved the status of the Declaration of Expenditure becomes Validated.

|

Remark |

In the final version of the Declaration of Expenditure, the User will have to provide the EU Login password during the validation process. |

Sign the Declaration of Expenditure

|

Remark |

The Sign can occur when a User wants to send its recorded data on a Declaration of Expenditure version to the Commission. The Declaration of Expenditure can only be sent once the Validation Errors have been removed and the status is Validated. To send the Declaration of Expenditure, the User must have the role of MS Accredited Paying Agency or Coordination Body with Send rights (MSPAs/MSCBs). |

-

Click on the Sign button to send the Declaration of Expenditure to the Commission:

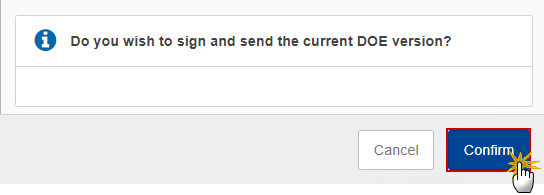

The system will ask you to confirm the sign and send action:

-

Click on Confirm to confirm.

On success, the Declaration of Expenditure version has been sent to the Commission. When signed, the status of the Declaration of Expenditure is set to Signed/Sent.

|

Remark |

In the final version of the Declaration of Expenditure, the User will have to provide the EU Login password during the signing process. In order to reopen the declaration for a period, the User should contact the Commission services, more specifically the EAGF Financial Management Unit at DG AGRI. |