ROLES

Roles involved for EAGF/EAFRD in the CB Report are:

|

MS Certification Authority Read Only MS Certification Authority Update MS Certification Authority Send |

Create the CB Reports, Consult the CB Reports, Record the CB Reports Upload the CB Reports Documents, Validate the CB Reports Send the CB Reports to upper node MS Create New Version of CB Reports, Delete the CB Reports

|

|

MS Coordinating Body Read Only MS Coordinating Body Send

|

Consult the CB Reports, Return the CB Reports to MS, Submit the CB Reports to EC

|

|

MS Acredited Paying Agency Read Only MS Acredited Paying Agency Send |

Consult the CB Reports, Return the CB Reports to MS, Submit the CB Reports to EC (only if there is no MS Coordinating Body)

|

General

This section includes the header data to identify the main characteristics of the CB Report.

Version Information

The Version information contains information on the identification and status of the CB Report like the Title, Fund, Version Number, Status, Current Node, etc.

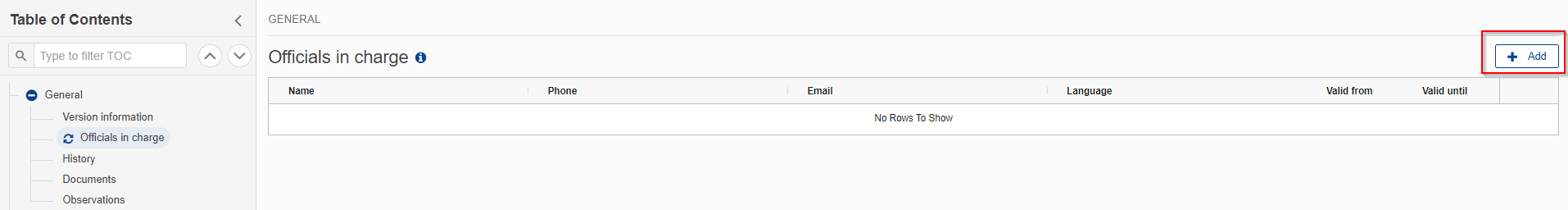

Officials in Charge

|

Note |

Officials in Charge can be updated at any time, independent from the status of the CB Report. Commission Officials (email domain "ec.europa.eu") can only be created/updated/deleted by Commission Users. |

-

Click on the Add button

to add a new official in charge.

to add a new official in charge. -

Clicking on the Edit icon

of a row will allow you to modify the information of this official.

of a row will allow you to modify the information of this official. -

Clicking on the Delete icon

of a row will allow you to delete the official in charge selected.

of a row will allow you to delete the official in charge selected.

-

Click on the Add button to add a new Official in Charge:

The Edit details pop-up window appears:

Enter or select the following information:

(1) Enter the Name.

(2) Enter the Email.

The format of the Email address will be validated by the system and should be unique.

(3) Enter the Phone number.

(4) Select the Language.

(5) Enter the Valid from and Valid until dates.

The Valid until date should be greater than the Valid from date.

(6) Click on Save to save the information.

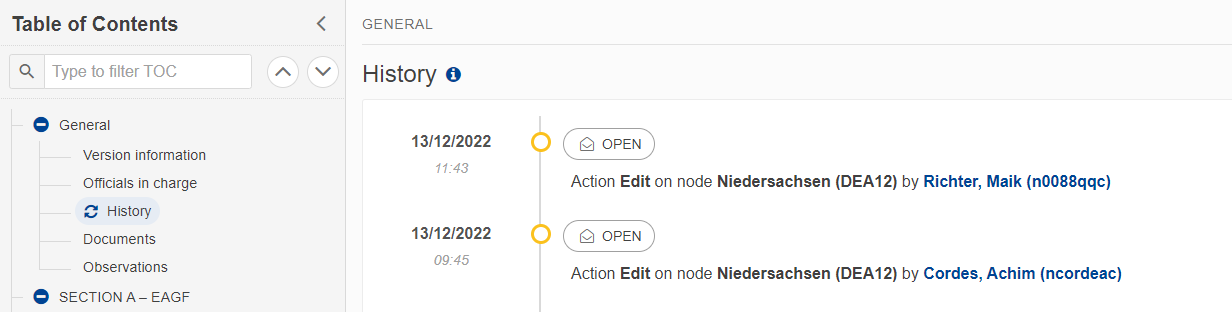

History

This section shows all the actions that have been taken on the Declaration of Expenditure since it was created, for example:

Documents

The Documents section shows all documents uploaded against this version of the CB Report by Member State Users.

Observations

This section is used to provide any relevant information related to the Partnership Agreement. It can be used as a type of 'chat' between the Member State and Commission.

SECTION A – EAGF

1 EXECUTIVE SUMMARY

1.1 Introduction

Following our appointment as auditors by the [name of national body, as appropriate], on the [date of appointment] [if applicable:], for a duration of [number of years/financial exercises] we have performed an audit of the [name of Paying Agency] pursuant to Article 9 (2) of Regulation (EU) No 1306/2013 of the European Parliament and of the Council in relation to its role as Paying Agency. This audit related to the Paying Agency’s operation of the European Agricultural Guarantee Fund (EAGF) for the financial year ended 15 October 20YY. The audit was undertaken in accordance with internationally accepted auditing standards and entailed consideration of the matters, set out in Article 5 (4) of Commission Implementing Regulation (EU) No 908/2014.

We are also required to provide an opinion as to whether the annual accounts for the EAGF year ended 15 October 20YY are a true, complete and accurate record of the amounts charged to the Fund, whether the internal control procedures have operated satisfactorily and whether the expenditure declared to the Fund is legal and regular. This opinion is contained in the Audit Opinion presented as part C of this report. We are further required to indicate whether our examination puts in doubt any assertions made in the management declaration. A separate section of the opinion deals with the Management Declaration.

Our work was performed in accordance with the requirements of Article 9 of Regulation (EU) No. 1306/2013 and Articles 5 to 7 of Commission Implementing Regulation (EU) No 908/2014. The format of this report is in accordance with the Commission guidelines.

Our work covered the Paying Agency's compliance with the accreditation criteria, the existence and functioning of the key internal controls and the procedures for ensuring compliance with EU rules, the legality and regularity of expenditure claimed for reimbursement from the Commission and the procedures for the protection of the financial interests of the EU. The findings and recommendations arising from our work are summarised in this Chapter and detailed under the relevant Chapters.

This report results primarily from the work undertaken by us since our appointment as a Certification Body to the Paying Agency in relation to the financial year ended 15 October 20YY. [Where applicable] It also draws upon the work performed by …….¬ [external audit body] or by the Internal Audit Unit of the Paying Agency [refer to section…..]. Additionally, we also considered audit evidence obtained from other providers, both internal and external, the details of which are outlined in Annex 2 to this report. Annex 1 to this Report contains a Glossary of Abbreviations used.

1.2 Conclusions at fund level per objective

Our audit work and reporting were designed according to the following audit objectives:

• Audit objective 1- Audit of the annual accounts ("accounts")

• Audit objective 2- Legality and regularity of expenditure ("legality and regularity"), including the Management declaration

The proper functioning of the internal control system is covered under both audit objectives.

Article 5 (4) of Commission Implementing Regulation (EU) No 908/2014, sets the questions which the certification body is required to respond to. These questions and our conclusions are set out below.

-

Requirement per Article 5 of Regulation 908/2014

Part/Audit objective

Conclusion

The Paying Agency complies with the accreditation criteria.

A and B; Audit objectives 1 and 2

For our overall opinion in this respect, refer to the Audit Opinion (see also the internal control system).

In general, the Paying Agency complies with the accreditation criteria [when applicable:] except….. [summarise major accreditation issues]

Key recommendations are summarised in subsection 12 below and are elaborated in more detail in the relevant sections of this report.

The annual accounts referred to in Article 29(chapter III) of Regulation No 908/2014 are in accordance with the books and records of the Paying Agency.

Part A; Audit objective 1

For details of our opinion in this respect see the Audit Opinion.

The statements of expenditure, and of intervention operations [delete reference to intervention if not applicable], are a materially true, complete and accurate record of the operations charged to the EAGF.

Part A; Audit objective 1

For details of our opinion in this respect see the Audit Opinion.

The financial interests of the Union are properly protected as regards advances paid, guarantees obtained, intervention stocks [delete reference to intervention if not applicable]and amounts to be collected.

Part A; Audit objective 1

The financial interests ….

For advances and guarantees ...

Reporting and reconciliation procedures for intervention are ...

The recovery of amounts outstanding is ...

The completeness of Annex II/III is ensured and detailed observations are included in section 5 of the report.

The Paying Agency's procedures are such as to give reasonable assurance that the expenditure charged to the EAGF was effected in compliance with Union rules, thus ensuring that the underlying transactions are legal and regular, and that recommendations for improvements, if any, have been followed-up.

Part B; Audit objective 2

For details of our opinion in this respect see the Audit Opinion.

1.3 Overall assessment of the internal control system and compliance with the accreditation criteria

1.3.1 Standard

Our assessment is based on our review of the internal control system (ICS) of the Paying Agency, including its compliance with the accreditation criteria. It is summarised in the matrix below using the following assessment criteria:

(1) Not working. There is a clear non compliance with one or more accreditation criteria or there are serious deficiencies. The seriousness of the deficiencies are such that the Paying Agency cannot fulfil the tasks set out in Article 7 of the Regulation (EU) No 1306/2013. Not all risks are addressed by controls and/or there are likely to be frequent control failures. The ICS functions poorly or does not function at all. The deficiencies are systemic and wide-ranging. High deviations were found that were not detected by the PA’s internal control system. As a consequence, no assurance can be obtained from the system. Scores = [1; 1,5]

(2) Works partially. There are other deficiencies which do not fall under (1), but which would have to be followed-up according to Article 2 (1) of Commission Implementing Regulation (EU) No 908/2014. All risks are addressed to some extent by controls which may not always operate as intended. Moderate deviations were found, which affected substantially the effectiveness of controls AND only part of these moderate deviations was detected by the PA’s ongoing controls and corrected by the PA itself. Scores = [1,51; 2,5]

(3) Works. Minor issues were detected but there is scope for improvement. All risks are adequately addressed by controls which are likely to operate effectively with some deficiencies having a moderate impact on the functioning of the key requirements. Only minor deviations were found, which did not affect substantially the effectiveness of controls. OR if those moderate deviations affected substantially the effectiveness of controls the PA’s ongoing controls detected them and the self-correcting mechanism of the PA operated. Scores = [2,51; 3,5]

(4) Works well. No deficiencies or only minor deficiencies were found. All risks are adequately addressed by controls which are likely to operate effectively. No exception was found. OR only minor (formal) deviations were found which did not affect substantially the effectiveness of controls and did not lead to financial errors. Scores = [3,51; 4,0]

In cases where the procedure / component is not valid, it is indicated as not-applicable (N/A). Our assessment is partly based on reviews carried out in previous financial years, where we have confirmed that no major changes in the procedures / components have occurred; in such cases our assessment is indicated in brackets "( )". As regards our assessment of the Internal Audit service, if certain areas are still to be audited by Internal Audit, we base our assessment on the adequacy of the five year audit plan. In such circumstances our assessment is also indicated in brackets "( )".

1.3.2 Detailed Assessment

Matrix I below concerns schemes under EAGF covered by the Integrated Administration and Control System (IACS), i.e. support schemes under EAGF established under Chapter II of Title V (articles 67 to 78) of Regulation 1306/2013 of the European Parliament and of the Council. Matrix II below concerns schemes under EAGF not covered by the IACS, i.e. support schemes under EAGF established under Chapter III of Title V of Regulation 1306/2013 of the European Parliament and of the Council. The general conclusion (overall scores at IACS and Non-IACS level) are provided in accordance with Section 5.4 of guideline 2 and reflected in our audit opinion.

[The matrices should be prepared on the basis of the matrices used for objectives –"accounts" and 2-("legality and regularity"), by merging the matrices developed for each objective].

[A separate matrix should be prepared for each population or strata tested because of the audit work conducted for objective 2 at population level. However, as the audit work for audit objective 1 is conducted at Fund level, the same scores should appear per IACS and Non-IACS. In addition, if some processes like debt management or execution of payments is conducted in the same way for the two Fund, the same scores will appear in the matrices in Part A and B. ]

1.3.2.1 IACS

Key to the table:

S – Score – should correspond to the assessments in Chapter 4

W – Weight given to each assessment criteria and the Internal Control System – corresponding to section 5.4 of guideline No 2

T – Total = Weight x Score

[EITHER:]

The overall assessment of the Internal Control System for the IACS population is [select one: does not work; it works partially; it works; it works well]

[Or]

On the basis of the internal control matrix above, the conclusion on the internal controls system for the IACS population would be that [select one: it does not work; it works partially; it works; it works well]. However, we do not agree with this conclusion. Our assessment used to determine the sample size for substantive testing is [select one: does not work; it works partially; it works; it works well] for the following reasons:

[ please elaborate]

1.3.2.2 Non-IACS

[Note: The above matrices are as per Guideline 2 on the annual certification audit. It provides a mathematical calculation of the overall assessment, based on the results of the testing reported in chapter 4 on compliance with the accreditation criteria. However, the Commission seeks the auditor's professional judgement. Therefore, if the CB is of the opinion that the resulting general conclusion presents a misleading assessment of the Internal Control System, the CB should:

-

-

-

-

-

-

-

Disregard the calculated general conclusion;

-

Indicate its professional assessment of the functioning of the Internal Control System;

-

Clearly explain the basis on which the CB made a different assessment. In all cases, the assessment should be in line with section 5.4 of guideline NO 2, i.e. 1 = does not work; 2 = works partially; 3 = works; 4 = works well.]

-

In case of score 1 attributed to particular components, the overall assessment1 of the Internal Control System should be reconsidered and adapted by using the weights to highlight these weaknesses. In case this is not done, the overall conclusion “works” or “works well” seems to be overstated.

-

-

-

-

-

-

[EITHER:]

The overall assessment of the Internal Control System for the IACS population is [select one: does not work; it works partially; it works; it works well]

[Or]

On the basis of the internal control matrix above, the conclusion on the internal control system for the non-IACS population would be that [select one: it does not work; it works partially; it works; it works well]. However, we do not agree with this conclusion. Our assessment used to determine the sample size for substantive testing is [select one: does not work; it works partially; it works; it works well] for the following reasons…please elaborate]

1.3.3. Overall assessment of the Internal Control System

Our overall assessment of the internal control system and compliance with the accreditation criteria for the EAGF is as follows:

-

Population / Strata

Assessment

Weight

EAGF – IACS

EAGF – non-IACS

Strata (please specify)

Total EAGF (weighted average)

1.3.4 Accreditation Status

[only use this part if there are/were changes affecting the accreditation status of the PA. Please describe the changes. In case of probation or provisional accreditation, please provide information on the accreditation criteria/procedure(s) and the population(s)/measure(s) affected, as well as on the probation period]

2 AUDIT STRATEGY OF THE CERTIFICATION BODY

[Note: the purpose here is not to repeat what is written in guideline No 2 on the audit strategy. The CB should explain the factors it considered in the overall approach and the results of the risk assessment implemented as part of the audit strategy. Only in case the CB decided to deviate from the standard approach (described in guideline 2) or modified its approach e.g. by applying specific sampling parameters, this should be duly explained.]

2.1 Audit risks and Control Risks assessment per population and/or scheme/measure

[provide a short summary on the results of the risks assessment for the fund per population/measure in accordance with the guidance in section 4.1 of guideline 2 related to the audit risk model (AR = IR x CR x DR). An assessment of IR and CR with the scores in guideline 2 should be provided. ]

2.2 Summary of Audit Strategy and Audit Plan for EAGF

• Audit scope and objectives;

[provide a short summary]

• Audit assurance and materiality per audit objective;

We based our assessment of the internal control system on the previous year's report. [However, if this was not the case it would have to be explained what it was based on.]

[provide a short summary]

• Systems and controls per audit objective;

- Audit objective 1:

[provide a short summary]

- Audit objective 2:

[provide a short summary]

• Risk assessment per audit objective;

[provide a short summary on the control risk assessment (the assessment of Inherent risk and control risk) at least per population in line with the table on p. 16 of guideline 2. This should be linked to the assessment of the ICS and the system assurance. ]

- Audit objective 1:

[provide a short summary]

- Audit objective 2:

[provide a short summary]

• The audit approach per audit objective;

[provide a short summary which should include the sampling approach per population/strata; dual-purpose testing, etc.]

[If the CB chose to apply the "Methodology document for the Certification bodies in respect of the audit work related to IACS cross-checks and data integrity to be performed in the context of the annual certification audit EAGF/EAFRD expenditure", it should be described here]

- Audit objective 1:

[provide a short summary]

- Audit objective 2:

[provide a short summary]

• Re-verification of on-the-spot controls;

[Describe the method used for the re-verification of on-the-spot controls (e.g. accompaniment of the PA's inspector, re-performance by the CB's own auditor, delegated; classical or control with remote sensing, whether there were rapid field visits. Describe whether the representativeness of the PA's random OTSC sample was tested and confirmed).

For the time-constrained measures, the timing of the re-verification needs to be mentioned as well. In particular, the CB should explain which procedures allowed the re-verification to be done as soon as possible after the PA's OTSC, and any specific consideration regarding the timing]

[Particularly for the non-IACS measures, elaborate on the key elements of the re-verifications for the measures selected and how the sub-sampling elements on the payments were selected for on-the-spot re-verifications (e.g.: based on invoices, nature of cost declared, etc).]

• The nature and extent of the CB's reliance on the work of Internal Audit, third party subcontracted auditors, specialists and experts, third party certificates from bodies accredited for the chosen international standard, etc. ;

[The CB may rely on the work of other auditors or technical experts

It should conduct sufficient work to get assurance on the appropriateness and quality of this work. See International Standard on Auditing ISA 600 " Using the work of another auditor", International Standard on Auditing (ISA) 610, “Considering the Work of Internal Audit” and ISA 620 "Using the work of an expert".

Provide a description of the work done by third parties and how the CB gained assurance of the quality of that audit work/which monitoring mechanisms were there in place. In case of changes of CB, explain to which extend the (new) CB relies on the work of the previous one, e.g. re-verifications already performed, sampling parameters already established]

In case only a part of the reverification is done by another party, this section should be filled.

• Any assumptions and estimations made during the course of the review;

[provide a short summary]

• Plan of audit activities;

[provide a short summary]

[Other information if applicable]

[Describe any other relevant information concerning the governance of the Paying Agency which was in one way of the other taken into consideration when designing the audit strategy.]

2.3 Resources

The audit team of the Certification Body in respect of the EAGF which performed the work comprised N professional staff. The resources dedicated to the project varied during the year as required. The qualifications of the personnel involved are summarised as follows:

-

Chartered Accountants

Others

TOTAL

Person days

Person days

Person days

N°

N°

N°

[In the case the Certification Body externalised the re-verifications] For the re-reverifications, the team which performed the work comprised N professional staff. The resources dedicated and the qualifications of the personnel involved are summarised as follows:

-

Qualification

Person days

N°

Total

N°

EAGF - PART A - Audit objective 1- Audit of the annual accounts

3 Compliance with Accreditation Criteria – Review of the Internal Control System

This section outlines the current status of the accreditation and provides the basis for the overall assessment of the internal control system and for our assessment in respect of the Paying Agency's compliance with the accreditation criteria per internal control procedure / component as indicated in the Accreditation Matrix used for audit objective 1. We have assessed the compliance with the accreditation criteria by using the grading "1" to "4". Our overall assessment is outlined below:

3.1 Understanding the entity/processes

[in line with guideline 2 part 4.2, describe the audit activities performed, the processes reviewed and insert the main conclusions regarding the control environment, particular risks and any development having occurred during the FY]

3.2 Compliance testing / test of controls - Control Activities

We confirmed our assessment of the accreditation procedures against the control activities by carrying out the following compliance testing/test of controls as suggested in guideline N° 2: [please indicate the number of transactions tested]

-

Procedure

IACS

Non - IACS

Findings (if any)

Payment procedures

Chapter X.X.X

Accounting procedures

Chapter X.X.X

Advances/securities

Chapter X.X.X

Procedures for debts

Chapter X.X.X

[The minimum sample size should be established in line with Section 5.3 of guideline No 2. The allocation of the sample for the compliance tests defined as the minimum sample size at Fund level among the different populations/strata, is to be determined by the CB based on its professional judgement.]

3.3 Evaluation per accreditation criterion

Annex I of Commission Delegated Regulation (EU) No 907/2014 sets out the accreditation criteria. [Procedures are to be reviewed in accordance with guidelines No 1 and 2. Based on the review of the control environment and the accomplished compliance testing, provide the assessment and findings for each control procedure. Scores (using the scoring system for accreditation criteria) are to be provided separately for IACS and Non-IACS. Financial errors (with financial impact on the accounts) are also to be reported and considered in the overall error evaluation, section 1.6.1. This should include an assessment of whether the deficiency is an isolated instance or represents a generic issue.

3.3.1 Control activities: Procedures for payment

[Provide an analysis per major/intermediate finding and the corresponding recommendation. Provide also a brief summary of the nature of deficiencies attributed a grading of 3, formal errors, confirm that these have no financial impact, and that these do not represent a generic/system issue Describe the financial errors that were detected]

1) ……….

2) ………

3.3.2 Control activities: Procedures for accounting

[Provide an analysis per major/intermediate finding and the corresponding recommendation. Provide also a brief summary of the nature of deficiencies attributed a grading of 3, formal errors, confirm that these have no financial impact, and that these do not represent a generic/system issue. Describe the financial errors that were detected]

1) ……….

2) ………

3.3.3 Control activities: Procedures for advances and securities

[Provide an analysis per major/intermediate finding and the corresponding recommendation. Provide also a brief summary of the nature of deficiencies attributed a grading of 3, formal errors, confirm that these have no financial impact, and that these do not represent a generic/system issue. Describe the financial errors that were detected]

1) ……….

2) ………

3.3.4 Control activities: Procedures for debts

[Provide an analysis per major/intermediate finding and the corresponding recommendation. Provide also a brief summary of the nature of deficiencies attributed a grading of 3, formal errors, confirm that these have no financial impact, and that these do not represent a generic/system issue. Describe the financial errors that were detected]

1) ……….

2) ………

3.3.5 Assessment

3.4 Other accreditation components

We confirmed our assessment of the other accreditation components against the standard (Annex I of Commission Delegated Regulation (EU) No 907/2014) by carrying out reviews/tests to ensure the Paying Agency's compliance with the criteria. [Procedures to be reviewed in accordance with guidelines No 1 and No 2. Based on the review provide here an assessment per accreditation component. Scores (using the scoring system for accreditation criteria) are to be provided. There should be a clear distinction between IACS and non-IACS (if relevant). All findings and recommendations related to grading of 1-3 should be reported. Financial errors (with financial impact on the accounts) are also to be reported and to be considered in the overall error evaluation. It should be assessed whether the deficiency is an isolated instance or represents a generic issue.]

3.4.1 Internal environment: Organisational structure

3.4.1.1 Description of the organisational structure

The Headquarters of the Paying Agency are located at … [address]. The Headquarters employ XXX persons corresponding to the full-time equivalent of YYY staff. [if only part of the staff works on PA matters:] Out of the staff of the institution, ZZZ persons work on tasks related to paying agency functions.

The Paying Agency also has WWW regional/local offices. The total number of people employed at these offices is VVV persons corresponding to the full time equivalent of PPP staff.

[Provide an analysis per major/intermediate finding and the corresponding recommendation. Provide also a brief summary of the nature of deficiencies attributed a grading of 3, formal errors, confirm that these have no financial impact, and that these do not represent a generic/system issue. Describe the financial errors that were detected]

1) ……….

2) ………

In our opinion, the scoring for this criterion is [1 – 4].

3.4.2 Internal environment: Human-resource standard

[Provide an analysis per major/intermediate finding and the corresponding recommendation. Provide also a brief summary of the nature of deficiencies attributed a grading of 3, formal errors confirm that these have no financial impact, and that these do not represent a generic/system issue. Describe the financial errors that were detected]

1) ……….

2) ………

In our opinion, the scoring for this criterion is [1 – 4].

3.4.3 Information and communication: Communication

[Provide an analysis per major/intermediate finding and the corresponding recommendation. Provide also a brief summary of the nature of deficiencies attributed a grading of 3, formal errors, confirm that these have no financial impact, and that these do not represent a generic/system issue. Describe the financial errors that were detected]

1) ……….

2) ………

In our opinion, the scoring for this criterion is [1 – 4].

3.4.4 Information and communication: Information Systems Security

3.4.4.1 Work Done (by population – IACS and non-IACS

We reviewed the compliance of the "Information Systems Security" with the requirements of the standard as stated above. Our services have carried out sufficient work to provide assurance on the appropriateness and quality of any work performed by other auditors, specialists and experts2 in the following areas: xx;xx;xx [if applicable].

The table below indicates the overall situation:

-

Yes / Not Applicable

No / Not Applicable

The yearly expenditure of the paying agency is more than €400 million:

[if no, please provide here the standard used by the PA (e.g. ISO 27002:2013 / BSI / COBIT)**]

The paying agency has obtained ISO 27001:2013 certificate/ISO 27001-Zertifikat auf der Basis von IT-Grundschutz:

[please provide the date of issue and the date of validity]

[if no, and the expenditure is more than €400 million, please provide further explanations below]

The certificate* covers all key tasks of the paying agency:

[if no, please provide further explanations below]***

The certificate* covers also delegated tasks:

[if no, please provide further explanations below]***

* For German paying agencies, the certificate is covering the interfaces to IT service providers which are responsible for the provision of outsourced IT application environments (where these are not provided in-house) and to other bodies which carry out delegated and outsourced paying agency tasks according to the 'Model of the information domain for EU paying agencies' (Modell Informationsverbund für EU-Zahlstellen).

** Please note that the standard in case of ISO is 27002:2013 for financial year 2016 (Annex I, 3 B of Regulation (EU) No 907/2014).

[In case the paying agency has obtained a valid ISO 27001:2013 certificate (for German paying agencies ISO 27001 certificate based on IT Grundschutz), and the scope of the certificate covers all key tasks of the paying agency, then the CB can rely on the certificate and no additional assurance work is required. The CB should provide the certificate as an annex to its report or a corresponding reference. However, in case the scope of the certificate is not covering all key and delegated tasks of the paying agency, then the CB should conduct sufficient work in the areas not covered by the certificate and report on them accordingly; or refer to 3rd party audit report. Nevertheless, in case the certificate was issued at the very end of the financial year 2016 or later (and therefore it was not valid for the full period of the financial year), the CB may consider to carry out some additional audit work based on its risk assessment.]

*** Assessed in accordance with the Statement of Applicability; and considering that delegated bodies must assure the same level of information security that is required for a paying agency.

[Delete if not appropriate:] The 3rd party certificate can be found [in annex/at the following address: https://.....].

[Delete if not appropriate:] As [a] Delegated Bodies[y] are[is] not covered in the ISO/BSI 27001 certificate or the Paying Agency is not ISO/BSI 27001 certified, the table(s) below describes the situation:

[In case of numerous Delegated Bodies, a list of delegated bodies and a description as suggested below per Delegated Body could be provided in an annex and not in the body of the report. Appropriate references to the annex should be made.]

Name of the Delegated Body(ies): ________________________________________

|

Control |

(Yes/No/NA) If not, please justify and/or provide possible comments below. |

|

The Service Level Agreement between the Paying Agency and the delegated body or Agreement or Memorandum of Understanding includes provisions on information systems security for the delegated body. |

|

|

The Paying Agency is monitoring that the security provisions in the agreements are complied with (e.g. by reviewing regular reporting from the Delegated Body). |

|

|

The Internal Audit Service is carrying out audits in the delegated body(ies) covering also IT security issues. |

|

|

Other units in the Paying Agency or service provider(s) are carrying out audits in delegated bodies covering also IT security issues. |

|

|

The Certification Body is carrying out audits in the delegated body(ies) covering also IT security issues. |

|

[Provide more tables if needed in case of several Delegated Bodies with a different status/situation]

[If certified, the CB should refer to that.]

[In case the PA has not been certified / or relating to areas and/or delegated tasks not covered by the certificate / or based on the CB's risk assessment: Provide here explanations of all significant findings for each domain of the chosen international standard. If there are no findings for a particular domain then state that "Our review has identified no findings in this domain".]

[For example: If the paying agency has chosen ISO 27002 as the basis of its information security, the certification body should review and report on each of the following domains:

- Information security policies

- Organization of information security

- Human resource security

- Asset management

- Access control

- Cryptography

- Physical and environmental security

- Operations security

- Communications security

- System acquisition, development and maintenance

- Supplier relationship

- Information security incident management

- Information security aspects of business continuity management

- Compliance]

[List here the major/intermediate recommendations only in case not already reported in chapter 1.7.]

In our opinion, the scoring for this component is [1 – 4].

3.4.5 Monitoring: Ongoing monitoring via internal control activities

[Provide an analysis per major/intermediate finding and the corresponding recommendation. Provide also a brief summary of the nature of deficiencies attributed a grading of 3, formal errors, and confirm that these have no financial impact, and that these do not represent a generic/system issue. Describe the financial errors that were detected]

1) ……….

2) ………

In our opinion, the scoring for this criterion is [1 – 4].

3.4.6 Monitoring: Separate evaluations via an internal audit service

[Provide an analysis per major/intermediate finding and the corresponding recommendation. Provide also a brief summary of the nature of deficiencies attributed a grading of 3, formal errors, and confirm that these have no financial impact, and that these do not represent a generic/system issue. Describe the financial errors that were detected]

1) ……….

2) ………

In our opinion, the scoring for this criterion is [1 – 4].

4 Substantive Testing of Operational and Non-Operational transactions

4.1 Introduction

In this section we provide an assessment of the substantive testing results. We have attached a list of all items selected for substantive testing, in the format proposed by the Annexes to guideline No 3 on the Reporting Requirements.

[Include the financial errors– from section 4.2 to 4.4 in the overall error evaluation section 6.]

4.2 Test results in respect of the EAGF – error rate

4.2.1 Overview

Our sample selection of (xxx) items was based on …

[insert the sampling methodology and parameters used]

4.2.2 Work Done

We reviewed in total (xxx) and an additional xx transactions in respect of EAGF following the requirements of guideline 2 – Audit Strategy. [explain if the testing was done at Fund level or at population level and whether dual-purpose testing was used].

The list of all cases appears in Annex 3: Sample reviewed in substantive testing – EAGF.

4.2.3 Assessment and Findings

[Provide an explanation of the nature of the financial errors found (random, known), listed in Annex 3, and possible root causes. Where formal errors are found, a clear conclusion has to be drawn that the formal errors indicated in the Annex 3 do not have a financial impact, and that these are of an incidental nature. Indicate also the significance of the findings (major/intermediate/minor) including a reference to the frequency with which they occurred

As mentioned in part 8.1 of guideline 2, a clearly trivial threshold of EUR 150 and 2 % of the audited amount is to be taken into account.]

|

Item nr |

XXXX |

Budget line |

XXXX |

|

|

Scheme/Measure: |

XXXX |

|||

|

Beneficiary reg. code: |

XXXX |

|||

|

Specific Legal basis: |

XXXX |

|||

|

Description of the finding(s): XXXXX |

||||

|

Impact: XXX |

||||

4.3 Overall test result of EAGF population

[Provide an assessment on the test result for the EAGF population.]

4.4 Test results of non-operational transactions.

For each of the audited populations, an assessment of the results of our testing is provided. The error evaluation is included in section 6. The findings are further detailed below.

4.4.1 Test results of tables of Annex II - irregularities

Annex 9 contains a detailed list of all transactions tested and the detected errors, including their financial value. [Link it to Annex 8 – Evaluation of Errors – Debtors - EAGF]

4.4.1.2 Assessment and Findings

[Provide an explanation of the nature of the financial errors found, listed in Annex 9, and possible root causes. Where formal errors are found, a clear justification has to be provided to explain why the formal errors found do not have a financial impact, and are of an incidental nature. Indicate also the significance of the findings (major/intermediate/minor) including a reference to the frequency with which they occurred.]

4.4.2 Test results on Tables of Annex III

Annex 10 contains a detailed list of all transactions tested and the detected errors, including their financial value. [Link it to Annex 8 – Evaluation of Errors – Debtors - EAGF]

4.4.2.2 Assessment and Findings

[Provide an explanation of the errors found, listed in Annex 10, and possible root causes. Indicate also the significance of the findings (major/intermediate/minor) including a reference to the frequency with which they occurred.]

4.4.3 Test results in respect of advances and securities

Annex 11 contains a detailed list of all transactions tested and the detected errors, including their financial value.

4.4.3.2 Assessment and Findings

[Provide here explanations for each financial error and for each significant finding. Where formal errors are found, a clear conclusion would have to be drawn that the formal errors indicated in the Annex 11 do not have a financial impact. Indicate also the significance of all findings (major/intermediate and minor) including a reference to the frequency with which they occurred.]:

5 Reconciliation of Monthly and Annual Declarations

5.1 Reconciliation of monthly and annual declarations of EAGF expenditure

5.1.1 Standard

To verify whether the final monthly indent (final table 104) agrees with the annual declaration for the 20XX EAGF financial year.

5.1.2 Work done

We have verified the differences and explanations in the electronic "diff." table (document/XXXX/XXXX, explanation-reconciliation codes "A") provided by the Paying Agency.

In addition, we assessed the Administrative Errors declared in the Monthly Declarations and those declared separately in the Annual Declaration. We also verified that the amount of administrative errors are not included in the Annex II and Annex III tables, and we also reviewed whether these have been credited to the Fund3.

5.1.3 Findings

5.1.3.1 Reconciliation of differences

|

Budget post |

Final Monthly Indent |

Annual Account |

Difference |

|

08 02 05 04 BPS |

61,826,826.57 |

61,849,976.50 |

23,149.93 |

|

08 02 99 xx Area aid for Rice |

9,201,802.82 |

9,201,802.82 |

- |

|

08 02. 05 xx xxxxx |

285,497.45 |

285,497.45 |

- |

|

Etc. |

4,254.23 |

4,254.23 |

- |

|

|

95,993.29 |

95,993.29 |

- |

|

|

35,761.77 |

35,761.77 |

- |

|

|

53,963,193.13 |

54,481,259.13 |

518,066.00 |

|

|

63,680,629.59 |

55,222,125.74 |

-8,458,503.85 |

|

|

62,946,699.25 |

62,946,699.25 |

- |

|

|

---------------------- |

-------------------- |

------------------- |

|

Total |

252,040,658.10 |

244,123,370.18 |

-7,917,287.92 |

|

|

============ |

============ |

=========== |

The differences are explained as follows:

[In case positive transactions are declared on the 62 budget codes or some other codes, that result in a reclaim from the Fund in the monthly declarations and in the annual declarations based on a Court/administrative body's decision, provide an assessment. The cancellation of a debt case, previously established, recovered from the beneficiary and returned to the Fund, can only be accepted if an administrative or legal instrument of a final nature records the absence of an irregularity. Therefore, confirm the following aspects:

amount recovered and reimbursed to the Fund;

date of recovery and reimbursement to the Fund;

date of decision cancelling the debt and an indication of the body issuing the decision (administrative / judicial body);

basis of the decision in favour of the beneficiary (absence of irregularity)4.

In case there are several transactions reclaiming previously recovered irregularities on the basis of Court/administrative decisions, provide details for the 5 largest transactions, and a general outline of the nature of the remaining cases.

In case there are other transactions that result in a positive difference between the final monthly indent and the annual declaration not covered by the code explanations, explain the substance of the underlying transaction. ]

The difference of XXXX on budget line XXXXXXXXXXXXXXX includes a reclaim from the Fund of a previously recovered irregularity in FY20XX.

We have reviewed the cases and the Court/administrative decisions for the underlying transactions, which were recovered and returned to the EU budget in the previous financial years and which were cancelled in the current financial year, following a decision [state whether administrative or Court judgment] of a final nature. We confirm the relevant information and that the ruling, in favour of the beneficiary, is based on the absence of an irregularity (substance issues –eligibility – of the case). Therefore, the reclaim of the previously recovered irregularities is justified and does not represent a risk to the Fund.

A detailed list of these debts with the relevant information is set out in the table below:

|

Debt ID |

Beneficiary ID |

Amount [national currency and EUR] recovered and returned to the EU budget in previous financial year and cancelled following administrative or court decision |

Financial year in which the recovered amount was returned to the EU budget |

No and date of decision/judgment establishing the absence of irregularity |

Grounds justifying the cancellation of the debt [brief description of the initial irregularity and of the final administrative/court decision] |

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

We can confirm that the Administrative Errors have been refunded. The total amount included in the declarations amounts to:

|

Administrative Errors (reported/deducted) |

Amount (EUR) |

|

1. Annual Declaration5 |

|

|

2. Monthly Declarations |

|

5.1.4 Assessment

We can confirm that, except for the remarks/explanations6 listed above, the provided electronic "diff." table (document/XXXX/XXXX, explanation-reconciliation codes "A") is complete and accurate, and the explanations given are valid and justified.

5.1.5 Recommendations

5.2 Reconciliation of annual declaration and X-table data of EAGF accounts

5.2.1 Standard

To verify whether the annual declaration agrees with the X-table data for the 20XX EAGF financial year.

5.2.2 Work done

We have reviewed the completeness, accuracy, and relevance of the electronic "diff." table (document/XXXX/XXXX, explanation-reconciliation codes "C" provided by the Paying Agency.

5.2.3 Findings

Reconciliation of differences

………..

1………

2………

………..

5.2.4 Assessment

We can confirm that, except for the remarks/explanations7 listed above, the provided electronic "diff." table (document/XXXX/XXXX, explanation-reconciliation codes "C") is complete and accurate, and the explanations given are relevant and justified.

5.2.5 Recommendations

5.3 Reconciliation of the information required by Annex II and Annex III of Commission Implementing Regulation (EU) No 908/2014 to the debtors' ledger - EAGF

5.3.1 Standard

To reconcile the closing balances of the previous financial year to the opening balances of the current financial year in respect of the debtors' ledger and the Annex II and Annex III tables.

To reconcile the data reported in Annex II and Annex III of Commission Implementing Regulation (EU) No 908/2014 to the debtors' ledger in respect of the current financial year.

5.3.2 Work done

5.3.3 Findings

Reconciliation closing balance n-1 / opening balance n

|

|

Closing balance FY n-1 (as at 15/10/n-1) |

Opening balance FY n (as at 16/10/n-1) |

Difference |

|

Annex II |

|

|

(1) |

|

Annex III |

|

|

(2) |

|

Debtors' ledger |

|

|

(3) |

We have reconciled the closing balances of the previous year's debtors' ledger, Annex II and Annex III tables and the opening balances of the current year debtors' ledger, Annex II and Annex III tables and we can confirm that there are no discrepancies

[In case discrepancies are identified, please provide the necessary justifications]

Justification of differences:…..

(1)…

(2)…

(3)…

-

Reconciliation of Annex II and Annex III to the debtors' ledger8

|

|

Balance 16 October

|

New cases |

Recovered amounts

|

Corrected amounts

|

Total non-cleared amounts declared irrecoverable

|

Amounts to be recovered by 15 October

|

|

Annex II |

|

|

|

|

|

|

|

Annex III |

|

|

|

|

|

|

|

Debtors' ledger |

|

|

|

|

|

|

|

Differences |

|

|

|

|

|

|

|

Explanation |

1 |

2 |

3 |

4 |

5 |

6 |

The explanations of the differences by column are:

The following discrepancies9 between the amounts used for this reconciliation in respect of Annex II and Annex III (as shown in the above table) and the amounts indicated in the final Annex II and Annex III tables provided by the Paying Agency were noted:

………..

We furthermore confirm that the closing balances mentioned on the summary tables of, respectively, Annex II and Annex III (amounts to be recovered as at 15 October n) tally with the sum of:

Opening balances (amounts to be recovered as at 16 October n-1 for respectively Annex II and Annex III)

+ New cases

+ / - corrected amounts

– Recoveries

– Irrecoverable amounts.

Confirmation of the Detailed table on recoveries related to previous programing periods

As part of our tests on Annex II, we reviewed the Detailed table established by the PA setting out the amounts related to recoveries related to previous programming periods. We confirm the figures mentioned in the table below:

|

|

FUND

|

Previous programming periods ONLY |

|||

|

|

Y=N |

Y=N-1 |

Y=N |

Y=N |

|

|

|

Recovered amount in financial year n |

Differences between the recovery order issued by the Commission for the financial year n-1 and the MS debtors' ledger |

Part of the amount already recovered and returned to the Commission by the 50/50 rule in previous financial years in application of Article 54 (2) of Regulation 1306/2013 |

Total amount to be returned to the Commission for FY N |

|

|

|

|||||

|

|

(a) |

(b) |

(c) |

(d) = (a) + (b) - (c) |

|

|

"Old" Cases |

TRDI |

|

|

|

|

|

"New" cases |

TRDI |

|

|

|

|

The justifications of the differences reported in column b are:

1.

2.

3.

4.

5.

[In case some of the amounts already recovered and returned to the Fund should be reclaimed from the Fund, provide an assessment. The cancellation of a debt case, previously established, recovered from the beneficiary and returned to the Fund, can only be accepted if an administrative or legal instrument of a final nature, can be taken into account, as a deduction, in the establishment of the recovery order for the recoveries made by the Paying Agency in the given financial year. In the event that such adjustment results in a credit in favour of the Member State, the balance will be deducted in the subsequent financial year(s).]

We have reviewed the amounts relating to debts from TRDI, which were recovered and returned to the EU budget in the previous financial years and which were cancelled in the current financial year, following a decision [state whether administrative or Court judgment], of a final nature. We confirm the relevant information and that the ruling, in favour of the beneficiary, is based on the absence of an irregularity (substance issues – eligibility – of the case). Therefore, we confirm that the total amount of [amount in the national currency and EUR] does not present a financial risk to the EU budget and can be deducted from the total final amount of the recovery order to be issued by the European Commission.

A detailed list of these debts with the relevant information is set out in the table below:

|

Debt ID |

Beneficiary ID |

Amount [national currency and EUR] recovered and returned to the EU budget in previous financial year and cancelled following administrative or court decision |

Financial year in which the recovered amount was returned to the EU budget |

No and date of decision/judgment establishing the absence of irregularity |

Grounds justifying the cancellation of the debt [brief description of the initial irregularity and of the final administrative/court decision] |

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

Confirmation of "50/50 tables"

As part of our tests on Annexes II and III, we reviewed the tables established by the PA setting out the amounts to be borne by the Member States according to the 50%/50% rule as well as the amounts to be borne in full by the EU budget following the Paying Agency’s decision not to pursue the recovery. We confirm that the procedures applied by the Paying Agency in this respect are in accordance with Article 54 (2) and (3)10 of Regulation (EU) No 1306/2013 and in line with Guideline 5, namely points 2, 4 and 6. We also confirm the figures mentioned in the table below:

[In case there are several irrecoverable cases based on code 211, provide details for the 5 largest transactions, and a general outline of the nature of the remaining cases.]

|

Paying Agency |

50% to be charged to the MS (Article 54(2) of Regulation (EU) No 1306/2013 |

100% to be borne by the EU budget (Article 54(3) of Regulation (EU) No 1306/2013 |

|

EAGF |

|

|

|

TRDI12 |

|

|

Furthermore, we have verified whether the Paying Agency reported in Annex II irrecoverable amounts for which the decision not to pursue recovery is classified as “other reasons than those provided for by Articles 54(3)(a) or 54(3)(b)”13 of Regulation (EU) No 1306/2013 and can confirm the following figures:

|

Fund |

Currency |

The total amount declared irrecoverable in Annex II of financial year N (other reason than Articles 54(3)(a) or 54(3)(b)) |

The part of the amount in column 'c' that was already subject to Article 54(2) in previous financial years |

|

a |

b |

c |

d |

|

EAGF |

|

|

|

|

TRDI |

|

|

|

5.3.4 Assessment

We confirm that the amounts mentioned in the Detailed table on recoveries related to previous programing periods and in the "50/50" tables are complete and accurate.

5.3.5 Recommendations

5.4 Reconciliation of annual Table 104 to the Annex II and Annex III of Commission Implementing Regulation (EU) No 908/2014

5.4.1 Standard

There must be a clear audit trail to support the reconciliation between the annual Table 104 and the Annex II and Annex III information.

5.4.2 Work done

We have reviewed both the adequacy of the procedures in place, and the outcome of the reconciliations.

5.4.3 Findings

Reconciliation of recoveries per annual Table 104 and recoveries included in Annex II and Annex III

Example:

-

Assigned revenue per annual Table 104 – Irregularities 80% (net amount)

Budget sub-item 62 00 00 00 0002 001

1.000.000,00

+ Assigned revenue per annual Table 104 – Irregularities not subject to 20% retention

Budget sub-item 62 00 00 00 0002 002

300 000,00

+ Assigned revenue per annual Table 104 – Cross-compliance (75%)– net amount

Budget sub-item 62 00 00 00 0003 0XX

75 000,00

+ Assigned revenue collected under the following budget sub-items 62 00 00 00 0004 001

- 25 000,00

Total (1) = recoveries as per Table 104

1 350 000,00

Recoveries in Annex II

1.550.000,00

+ Recoveries in Annex III

100.000,00

Total (2)

1.650.000,00

Difference (2) – (1)

300.000,00

Explanations of differences:

1. 20% of retention related to revenue assigned on budget sub-item 62 00 00 00 0002 001: +250 000

2. 25% of retention related to revenue assigned on budget sub-item 62 00 00 00 0003 028: +25 000

3. Amounts recovered in T104 as reclaim of any amounts previously charged to the MS under the 50/50 rule in cases of a final decision by an administrative or legal instrument on the absence of an irregularity, not reported under "recoveries" in the Annex III tables : + 25 000

4. Other differences: 0,00

Discrepancies14 between the amounts listed in the above table and the amounts indicated in the final Annex II and Annex III tables provided by the Paying Agency, are explained as follows:………..

[The table above is an example using some of the possible budget sub-items under the Chapter 6200 EAGF- assigned revenue, and therefore does not systematically reflect the evolution of the detailed nomenclature for each year. All recoveries booked under these sub-items (from 62 00 00 00 0002 001to 62 00 00 00 0004 001) should be considered.].

5.4.4 Assessment

We reviewed the Paying Agency's reconciliation process and are satisfied that it was performed properly.

5.4.5 Recommendations

5.5 Confirmation of advances

5.5.1 Objective

To review the confirmation of the stock of advances still to be cleared at the end of the financial year as submitted by the Paying Agency within the annual accounts in accordance with Article 29 of Regulation (EU) 908/2014.

5.5.2 Work done

We have reviewed the table(s) established by the Paying Agency, presenting the amounts of advance payments not yet cleared as at 15 October N (Annex 4 a).

5.5.3 Findings

No differences have been identified.

5.5.4 Assessment

We confirm that the amounts mentioned in Annex 4 a) are complete and accurate and correspond to the cumulative net and not yet cleared outstanding advances (as defined in paragraph 5.3.1 of guideline no 1), paid to beneficiaries under EAGF.

[In case of discrepancies between the amounts reported by the PA and the CB's findings, please indicate the percentage of deviation between what was reported and what should have been reported and provide the necessary justifications for the difference. In case of the measures of the wine sector if the un-cleared amounts do not equal to the unused amounts, the unused amounts needs to be mentioned and certified separately.].

5.6 Review of Financial Ceilings

5.6.1 Work to be done

We reviewed whether relevant procedures are in place to ensure that the total payments per budget line do not exceed the maximum financial ceilings.

[Where measures are subject to quantitative limits, either in terms of total amounts paid, production or eligible areas, check that procedures are in place to ensure that the total payments [for all the PAs in one Member State taken together] remain within these quantitative limits. This includes an examination based on the Ceilings set out in Council Regulations (EC) No. 1307/2013].

5.6.2 Conclusion

The … [name of institution/unit] is responsible for the monitoring of the financial ceilings. For each scheme, it monitors the payments made and verifies the totals against the approved limits.

[if applicable:]For the financial year 20XX, the financial ceilings were exceeded for the following budget lines:

… [budget line, ceiling, overrun]

…

The overshooting of the financial ceilings was subject to a reduction by the Commission on … [date].

5.6.3 Recommendations

[either describe the findings or indicate: Not applicable].

5.7 Non-respect of payment deadlines

5.7.1 Objective

[To verify the timely treatment of payment claims by the Paying Agency for EAGF Non-IACS, in particular whether the interval between receipt of the supporting documents needed to make the payment and the issuing of the payment order does not exceed legal deadlines.15]

We reviewed, according to Article 5(2) of Regulation (EU) No 907/2014, the adequacy of the procedures in place and the outcome of the reconciliations ensuring that the Paying Agency does not exceed legal deadlines as mentioned above and if it exceeds the legal deadlines the expenditure effected after the deadlines is equal to or less than 5 % of the expenditure effected before the deadlines. In case the expenditure effected after the deadlines is above the threshold of 5 %, we analysed the financial data on payments made after the deadline (payments per month) above the 5 % reserve and we confirm the provided payment data.

5.7.2 Work done

[To assess that the Paying Agency has adequate procedures in place in order to timely process the payment claims and to ensure that legal deadlines between the receipt of the supporting documents needed to make the payment and the issuing of the payment order are not exceeded.

To review against the X-tables that the interval between receipt of the supporting documents needed to make the payment and the issuing of the payment order does not exceed the legal deadlines according to the different sectorial regulations16.

To perform analytical audit procedures in order to calculate, following the rules of Article 5(2) of Regulation (EU) No 907/2014, the financial impact that should be followed up when the expenditure effected after the deadlines is above the threshold of 5 %.]

5.7.3 Findings

[Report on the findings with reference to the particular element of the annual declaration.]

5.7.4 Conclusion

[To conclude whether the amount requested for reimbursement is effected within the deadlines per sectorial regulation and whenever the provisions of Article 5(2) of Regulation (EU) No 907/2014 should be applied, to confirm the actual payments made after the legal deadline, above the 5 % reserve per month, to provide estimations of the financial impact and to describe the methodology for its calculation.]

5.7.5 Recommendations

6 Overall error evaluation

[The total financial impact arising from errors found relating to objective 1-"accounts" is to be compared to the materiality established at Fund level for drawing the overall conclusion on the annual accounts in the Audit Opinion. CBs are requested to use the excel table provided below.]

6.1 Detailed Error Evaluation

6.1.1 Error evaluation for the operational expenditure

[in case the CB carried out its testing for objective 1-"accounts" at population level, please provide the details per population in the table below. Note that the conclusion on objective 1 should be at Fund level, so please provide an overall conclusion also at Fund level].

Our error evaluation of the statistical sample populations is outlined below:

A detailed table of all items tested and the detected errors including their financial values is attached (see Annex 3 Sample reviewed in substantive testing – EAGF) to this report. We also attach (in Annex 6: Reconciliation of gross amount of tested expenditure to the Annual Declaration) a summary of the budget lines, reconciled to the gross amount of expenditure declared and tested, [apportioned for both the IACS and Non-IACS populations if applicable].

[In case of errors] Overall conclusion – It is our opinion that the detected formal errors have no financial consequences, and that these are not of a recurrent nature. The substantive errors are mainly the result of [please elaborate.]. These errors are explained in more detail in chapter 4.

6.1.2 Error evaluation for non-operational expenditure: debts, advances and securities

As regards debts our detailed error evaluation is provided in the table below.

A detailed table of all cases checked and the detected errors including their financial value is attached (see Annex 9: Sample reviewed in substantive testing – EAGF Annex II Tables and Annex 10: Sample reviewed in substantive testing – EAGF Annex III Tables) to this report.

As regards advances and securities our error evaluation is outlined below:

A detailed table of all cases tested and the detected errors including their financial value is attached (see Annex 11: Sample reviewed in substantive testing – EAGF Advances and Securities) to this report.

[In case of errors] Overall conclusion – In our opinion the detected formal errors have no financial consequences. These errors are explained in more detail in chapter 5.

7 Overall conclusions

7.1 Nature of Findings

Our work resulted in a number of findings which led to various recommendations. For each finding, a level of importance was attributed in accordance with the following grading:

Accreditation issues:

-

- Major Findings

Matters which require immediate attention by the Competent Authority and the Head of the Paying Agency, corresponding to grade (1) in the accreditation matrix (refer to guideline No 1 on accreditation).

- Intermediate Findings

Matters which concern the general control environment and require prompt attention at a senior level within the Paying Agency and the Competent Authority, corresponding to grade (2) in the accreditation matrix.

- Minor Findings

Minor issues highlighted, which require attention at an appropriate level within the Paying Agency, corresponding to grade (3) in the accreditation matrix.

Annual account issues:

-

- Major Findings

Matters which require immediate attention by the Competent Authority and the Head of the Paying Agency.

- Intermediate Findings

Matters which concern the general control environment and require prompt attention at a senior level within the Paying Agency and the Competent Authority.

- Minor Findings

Minor issues highlighted, which require attention at an appropriate level within the Paying Agency.

Internal Control System issues:

-

- Major Findings

Matters which require immediate attention by the Competent Authority and the Head of the Paying Agency.

- Intermediate Findings

Matters which concern the general control environment and require prompt attention at a senior level within the Paying Agency and the Competent Authority.

- Minor Findings

Minor issues highlighted, which require attention at an appropriate level within the Paying Agency.

Recommendations related to minor findings are (in principle) not included in this reports but are communicated separately to the Paying Agency's management in our letter of recommendations. A list of minor recommendations is available to the Commission on request.

7.2 Major Findings

[When applicable:] We identified a number of issues giving rise to major recommendations which are summarised in the table(s) below.

[Note that a major accreditation finding should be linked to a grade 1 ("not working") score in the matrix tables. Exceptions to this rule may only be granted in very particular circumstances and need to be duly justified and explained.]

The following major findings were established in respect of accreditation/internal control system issues:

|

Finding |

Section |

Recommendation |

Response of Paying Agency |

CB assessment of PA response |

|

|

|

|

|

|

The following major findings were established in respect of accounting issues:

|

Finding |

Section |

Recommendation |

Response of Paying Agency |

CB assessment of PA response |

|

|

|

|

|

|

7.3 Intermediate Findings

[When applicable:] We have identified a number of issues giving rise to intermediate recommendations which are summarised in the table(s) below.

The following intermediate findings were established in respect of accreditation/internal control system issues:

|

Finding |

Section |

Recommendation |

Response of Paying Agency |

CB assessment of PA response |

|

|

|

|

|

|

The following intermediate findings were established in respect of accounting issues:

|

Finding |

Section |

Recommendation |

Response of Paying Agency |

CB assessment of PA response |

|

|

|

|

|

|

EAGF - PART B - Audit objective 2- Legality and regularity of expenditure

8 Review of the Internal Control System

This section outlines the current status of the accreditation and provides the basis for the overall assessment of the internal control system and for our assessment in respect of the Paying Agency's compliance with the accreditation criteria per internal control procedure / component as indicated in Matrices [I and II]. We have assessed the compliance with the accreditation criteria by using the grading "1" to "4". Our overall assessment is outlined below:

8.1 Understanding the entity / processes

[in line with guideline 2 part 10 referring to part 4.2, insert the main conclusions regarding processes checked, the control environment, particular risks and any development having occurred during the FY]

[any work and assessment according to part 11.2.1 review of IT general controls and 11.2.2 Review of IT application controls of guideline 2 should be inserted in this part]

[If used, please refer to the "methodology document for the Certification bodies in respect of the audit work related to IACS cross-checks and data integrity to be performed in the context of the annual certification audit EAGF/EAFRD expenditure" work in this part]

[please explain how the testing was conducted in line with section 11.3 of guideline 2 and how the samples were established].

8.2 EAGF IACS - Compliance testing / Test of controls - Control Activities

We confirmed our assessment of the control activities by carrying out the following compliance tests/tests of controls against the key and ancillary controls as suggested in guideline N° 2: [please indicate the number of transactions tested]

-

Procedure

IACS

Findings (if any)

Chapter X.X.X

Chapter X.X.X

[The minimum sample size should be established in line with Section 5.3 of guideline No 2.

8.2.1 Control activities: Authorisation of payments – Key controls related to administrative controls

[split according to the different schemes tested and the relevant key controls, as well as ancillary controls and key controls]

[Provide an analysis per major/intermediate findings and the corresponding recommendations. Provide also a brief summary of the nature of deficiencies attributed a grading of 3, formal errors, confirm that these have no financial impact, and that these do not represent a generic/system issue. Describe the financial errors that were detected]

1) ……….

2) ………

8.2.2 Control activities: Authorisation of payments – Key controls related to on-the-spot controls

[split according to the different schemes tested and the relevant key controls, as well as ancillary controls and key controls]

[Provide an analysis per major/intermediate findings and the corresponding recommendations. Provide also a brief summary of the nature of deficiencies attributed a grading of 3, formal errors, confirm that these have no financial impact, and that these do not represent a generic/systemic issue. Describe the financial errors that were detected]

1) ……….

2) ………

8.2.3 Control activities: Authorisation of payments – Ancillary controls

[split according to the different schemes tested and the relevant ancillary controls for the particular scheme]

[Provide an analysis per major/intermediate findings and the corresponding recommendations. Provide also a brief summary of the nature of deficiencies attributed a grading of 3, formal errors, confirm that these have no financial impact, and that these do not represent a generic/system issue. Describe the financial errors that were detected]

1) ……….

2) ………

8.2.4 Internal environment: Delegation

8.2.4.1 Summary of delegated tasks

The Paying Agency has delegated tasks to other institutions (referred to as "delegated bodies") as per the table below [or in an Annex if necessary]:

-

Name of the Institution

Type of tasks delegated

Date of the delegation agreement

…..

…

We confirm that the rules and guidelines regarding the delegation of tasks are described in detail in the delegation agreements listed above [when applicable:] as well as in the … [applicable legal text: law/regulation/ministerial decree, number and date]. In addition, the Paying Agency issued a set of instructions for each specific scheme, which covers the quality aspects and the reporting on the delegated tasks.

[Provide an analysis per major/intermediate finding and the corresponding recommendation. Provide also a brief summary of the nature of deficiencies attributed a grading of 3, formal errors, confirm that these have no financial impact, and that these do not represent a generic/system issue. Describe the financial errors that were detected]

1) ……….

2) ………

8.2.5. Assessment

In our opinion, the scoring for this criterion is [1 – 4].

8.3 EAGF Non-IACS - Compliance testing / Test of controls - Control Activities

We confirmed our assessment of the control activities by carrying out the following compliance tests/tests of controls against the key and ancillary controls as suggested in guideline N° 2: [please indicate the number of transactions tested]

-

Procedure

Non-IACS

Findings (if any)

Chapter X.X.X

Chapter X.X.X

8.3.1 Control activities: Authorisation of payments – Key Controls related to administrative controls

[split according to the different measures tested and the relevant key controls for the particular measure]

[Provide an analysis per major/intermediate findings and the corresponding recommendations. Provide also a brief summary of the nature of deficiencies attributed a grading of 3, formal errors, confirm that these have no financial impact, and that these do not represent a generic/system issue. Describe the financial errors that were detected]

1) ……….

2) ………

8.3.2 Control activities: Authorisation of payments – Key Controls related to on-the-spot controls

[split according to the different measures tested and the relevant key controls for the particular measure]

[Provide an analysis per major/intermediate finding and the corresponding recommendations. Provide also a brief summary of the nature of deficiencies attributed a grading of 3, formal errors, confirm that these have no financial impact, and that these do not represent a generic/system issue. Describe the financial errors that were detected]

1) ……….

2) ………

8.3.3 Control activities: Authorisation of payments – Ancillary Controls

[split according to the different measures tested and the relevant ancillary controls for the particular measure]

[Provide an analysis per major/intermediate findings and the corresponding recommendations. Provide also a brief summary of the nature of deficiencies attributed a grading of 3, formal errors, confirm that these have no financial impact, and that these do not represent a generic/system issue. Describe the financial errors that were detected]

1) ……….

2) ………

8.3.4 Internal environment: Delegation

8.3.4.1 Summary of delegated tasks

The Paying Agency has delegated tasks to other institutions (referred to as "delegated bodies") as per the table below [or in an Annex if necessary]:

-

Name of the Institution

Type of tasks delegated

Date of the delegation agreement

National Forestry Agency (EU Coordination Unit)

EAGF Non-IACS on-the-spot controls

Signed: 22.01.2011, updated: 25.02.2014

…

We confirm that the rules and guidelines regarding the delegation of tasks are described in detail in the delegation agreements listed above [when applicable:] as well as in the … [applicable legal text: law/regulation/ministerial decree, number and date]. In addition, the Paying Agency issued a set of instructions for each specific scheme, which covers the quality aspects and the reporting on the delegated tasks.

[Provide an analysis per major/intermediate finding and the corresponding recommendation. Provide also a brief summary of the nature of deficiencies attributed a grading of 3, formal errors, confirm that these have no financial impact, and that these do not represent a generic/system issue. Describe the financial errors that were detected]

1) ……….

2) ………

8.3.5. Assessment

In our opinion, the scoring for this criterion is [1 – 4].

9 SUBSTANTIVE TESTING

9.1 Test results in respect of the EAGF IACS population

9.1.1 Overview

Our sample selection (xxx) was based on …

[insert the sampling methodology and parameters used]

[the CB should detail its sampling methodology and explain in summary how the PA drew its sample (population, method, whole farm approach or not, etc), and how the CB proceeded, for example taking into account considerations on cascade sampling. The CB should state whether the representativeness of the PA's random OTSC sample was tested and confirmed. In addition, the CB should explain what approach was used for the selection of the sub-sample- parcels, animals, etc.in line with annex 2 of guideline 2 on the two-stage sampling. ]

9.1.2 Work done

We reviewed in total (xxx) and an additional xx transactions in respect of EAGF IACS, following the requirements of the standard as stated above. The list of all cases appears in the Annex 4: Incompliance Rate – EAGF IACS.

9.1.3 Assessment and Findings

[Provide an overview of the net deviations (cf. section 3.1.1.c. of Annex 5 of guideline 2) listed in the Annex 4, and an analysis of the underlying causes. Where formal errors are found, a clear conclusion has to be drawn that the formal errors indicated in Annex 4 do not have a financial impact, and that these are not of a recurrent nature. Indicate also the significance of the findings (major/intermediate/minor) including a reference to the frequency with which they occurred.]

|

Item nr |

XXXX |

Budget line(s) |

XXXX |

|

|

Measure(s) tested: |

XXXX XXXX |

|||

|

Beneficiary reg. code: |

XXXX |

|||

|

Specific Legal basis: |

XXXX |

|||

|

Description of the finding(s) per scheme/measure: XXXXX

Points of disagreement with the Paying Agency : XXXXX |

||||

|

Impact: XXX |

||||

9.2 Test results in respect of the EAGF Non-IACS population

(see the text above)

9.2.1 Overview