Quarterly Declaration of Expenditure (IPA-RD)

PURPOSE

This document describes the specifications and details related to Quarterly Declaration of Expenditure for IPA-RD (Instrument for Pre-Accession Assistance (IPA II) in Rural Development). The main objective of this module is to allow (Candidate) Member State Paying Agency/Coordination Body to declare – during a limited period - eligible amount expenditure for which it has actually paid the corresponding IPA-RD contribution during the quarter and referenced as Q1 to Q4 YYYY.

REGULATIONS

More detail regarding the regulation of the Quarterly Declaration of Expenditure can be found in About SFC2014 section of this portal.

ROLES

Roles involved in the Quarterly Declaration of Expenditure for IPA-RD are:

|

(Candidate) MS Accredited Paying Agency (Candidate) MS Coordination Body |

Create Quarterly Declaration of Expenditure Record/Edit Quarterly Declaration of Expenditure Upload Quarterly Declaration of Expenditure Documents Consult Quarterly Declaration of Expenditure Validate Quarterly Declaration of Expenditure Send Quarterly Declaration of Expenditure Delete Quarterly Declaration of Expenditure Cancel Quarterly Declaration of Expenditure Return Quarterly Declaration of Expenditure Create New Version of Quarterly Declaration of Expenditure |

|

(Candidate) MS Managing Authority (Candidate) MS Audit Authority |

Consult Quarterly Declaration of Expenditure |

FUNDS

|

IPA(d) |

|

|

|

Workflow

This section shows the lifecycle to create and manage a Quarterly Declaration of Expenditure.

Click here to see the QDOE workflow diagram in high resolution.

Create a Quarterly Declaration of Expenditure (IPA-RD)

|

Remark |

A Rural Development Programme must be 'Adopted by EC' before a Quarterly declaration of Expenditure can be created. It is a must to have the role of the ‘(Candidate) MS Accredited Paying Agency’ OR ‘(Candidate) MS Coordination Body’ with Update access. |

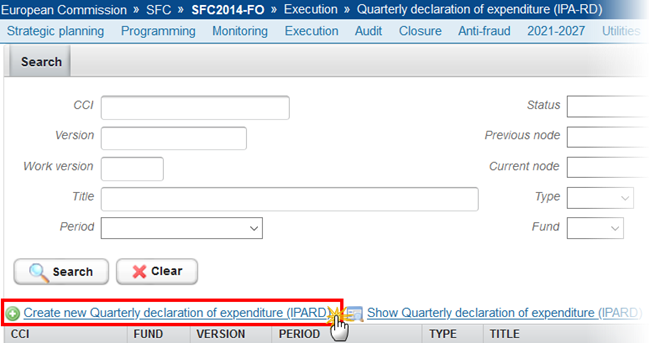

1. To access the Quarterly Declaration of Expenditure section first click on the "Execution" menu and then on the "Quarterly Declaration of Expenditure (IPA-RD)" link.

2. Click on the Create new Quarterly Declaration of Expenditure (IPA-RD) link to create a new Quarterly Declaration of Expenditure.

You are redirected to the Quarterly Declaration of Expenditure creation wizard:

3. Select or enter the following information:

Select the CCI code from the drop-down menu.

The CCI list contains all adopted Programmes (last adopted version present at the first date of the Expenses Period) managed on your Node(s) and which contain Fund IPA(d) for which you are registered.

The Version (=year and quarter) are selected by default.

|

REMARK |

The Quarterly Declaration of Expenditure can only be created and submitted during the month following the Expenditure Period. Therefore the Expenditure Period is automatically set by the system. Expenses occurred during: · The first Quarter (YYYYQ1 = 01/01/YYYY to 31/03/YYYY) can only be created from Declaration Period 01/04/YYYY to 30/04/YYYY. · The second Quarter (YYYYQ2 = 01/04/YYYY to 30/06/YYYY) can only be created from Declaration Period 01/07/YYYY to 31/07/YYYY. · The third Quarter (YYYYQ3 = 01/07/YYYY to 15/10/YYYY) can only be created from Declaration Period 16/10/YYYY to 10/11/YYYY. · The fourth Quarter (YYYYQ4 = 01/10/YYYY to 31/12/YYYY) can only be created from Declaration Period 01/01/YYYY+1 to 31/01/YYYY+1. Exception, in case of the first declaration the start Expenditure Period is always 01/01/2014. |

Declaration Type is by default selected as "Interim".

The (Expenditure) period is defined by the system.

A National Reference for this declaration can be added (not mandatory)

Click on 'Finish'.

The status of the Declaration of Expenditure is now Open.

|

REMARK |

On Create, the structure of a Quarterly Declaration of Expenditure (IPA-RD) is based on the Financial Plan in force the first day of the Expenditure period. The Quarterly Declaration of Expenditure (IPA-RD) is linked to the last adopted version (version in force) of the Rural Development Programme present the first day of the Expenditure Period. The first Quarterly Declaration of Expenditure (IPA-RD) will be linked to the last adopted version (version in force) of the IPA-RD Programme present at the creation date of the Quarterly Declaration of Expenditure (IPA-RD). |

Record/Edit the Quarterly Declaration of Expenditure (IPA-RD)

|

Remark |

When editing a version of a Quarterly Declaration of Expenditure, its status is 'Open', 'Ready to send' or 'Sent' at the level of the (Candidate) Member State and currently resides on the user's level. |

Find all the information to complete each screen of the Quarterly Declaration of Expenditure. Below are the links to the main sections:

· General

· Paying Agency and Bank Account

General

Version Information

The version information contains information on the identification and status of the DOE Version like the CCI, the Title, the Type, the Fund, the Version Number, the Status, the Node where it currently resides and the Accounting Period. It also shows the results of the last validation done on this DOE version.

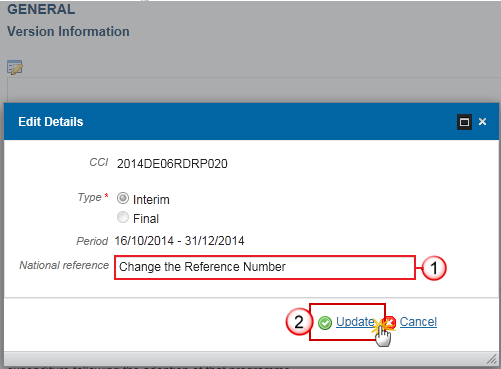

The Version information for the Quarterly Declaration of Expenditure cannot be modified once the version has been created; only the National Reference can be updated.

1.

Click on the Edit Button  to

modify the information.

to

modify the information.

2. Enter the following information:

Enter the National Reference.

Click on Update to update the information.

The display will also contain a Print link allowing generating a PDF version. It can be used to verify what has been entered in the system and what has been modified compared to any previous version of the same Expenditure Period and will by default show the previous version.

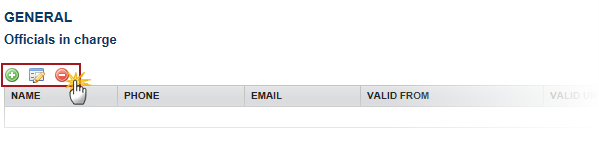

Officials in Charge

|

Note |

Officials in Charge can be updated at any time, independent from the status of the Quarterly Declaration of Expenditure. |

·

Click on the Add button  to add a new official in charge.

to add a new official in charge.

·

Select an official and click in the Edit button  to modify the information of this

official.

to modify the information of this

official.

·

Select an official and click on the Remove button  to delete the official in charge

selected.

to delete the official in charge

selected.

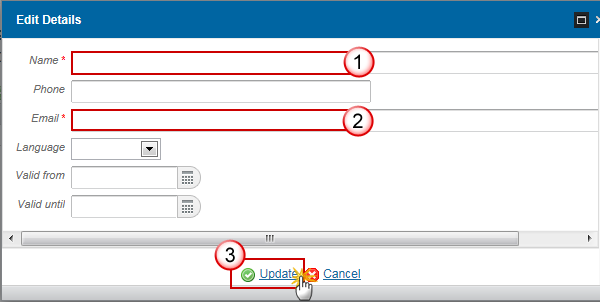

1.

Click on the Add button  to add a new official in charge

to add a new official in charge

2. Enter the following information:

Enter the Name.

Enter the Email.

Click on Update to save the information.

|

Note |

Commission Officials (email domain "ec.europa.eu") can only be created/updated/deleted by Commission Users. The email is directly accessible via the email link. |

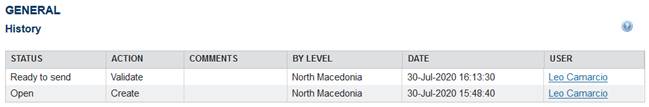

History

This section shows all the actions that happened in the Quarterly Declaration of Expenditure since it was created and the resulting status, for example:

The email of the user is directly accessible via the email link.

Documents

The following documents list will be foreseen:

|

Description |

Non-Integral |

Integral |

System |

Required |

|

Other Candidate Member State Document |

X |

|

|

|

|

Request to withdraw payment application |

X |

|

|

|

|

Other Adjustments Justification* |

|

X |

|

|

|

Snapshot of data before send |

|

X |

X |

X |

*Only if negative amounts are provided for other adjustments

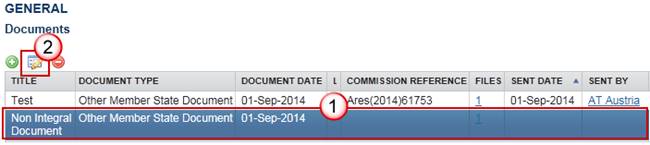

Uploading & Sending Documents

Multiple documents can be uploaded in the Quarterly Declaration of Expenditure.

·

Clicking on the Add button  will open a pop up window allowing

you to add a new document type with attachments.

will open a pop up window allowing

you to add a new document type with attachments.

·

Selecting a document row and click in the Edit button will allow you to modify the

document information. If a document of type 'Other Candidate Member State Document' must be sent, you can select the edit button

in order to send the document.

will allow you to modify the

document information. If a document of type 'Other Candidate Member State Document' must be sent, you can select the edit button

in order to send the document.

|

Remark |

Referential Documents (ie. 'Other Candidate Member State Document') can be sent at any time independently of the status of the Quarterly Declaration of Expenditure. A document is only visible to the Commission when the sent date is visible:

|

1.

Click on the Add button  to add a new document.

to add a new document.

The document details pop-up window appears:

2. Enter or select the following information:

Select a Document Type

Enter a title for your Document

Enter a Document Date

Click on the Add button  to add a new attachment

to add a new attachment

·

You can add multiple attachments by clicking on

the Add button

·

You can remove unwanted attachments by selecting

the attachment and clicking on the Remove button

Enter a Title for your attachment.

Select the Language of the document.

Select the file to upload.

Click on Update to save the information or Update & Send to send the document to the Commission.

|

Remark |

Commission Registration N° is only enabled for Commission Users, while Local Reference is only enabled for (Candidate) Member State Users. |

The pop-up window closes and the documents are uploaded:

Sending an unsent non-integral document

1. To

send a non-integral document that is not yet sent: once the document and

attachment(s) have been uploaded select the document row in the list and click on the Edit button :

:

2. Click on Update & Send to send the document to the Commission.

|

Note |

The "Update & Send" button will only be shown for documents which are not integral part of the Quarterly Declaration of Expenditure and after at least one attachment was added. |

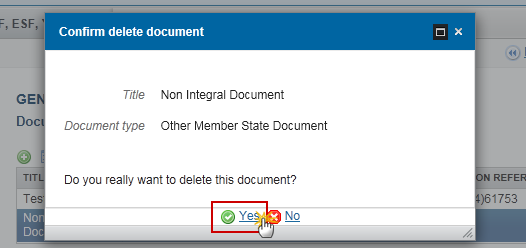

Deletion of an unsent document

|

Remark |

Only documents that have not yet been sent to the Commission can be deleted. |

1.

Select a row of a previously

uploaded document and click on the Remove button  to delete the

document and associated attachments.

to delete the

document and associated attachments.

A confirmation window appears:

2. Click on 'Yes' to confirm deletion. Click on 'No' to return to the Quarterly Declaration of Expenditure documents.

Hiding a sent document

|

Note |

Sent Documents can never be deleted, but the sender can decide to hide the content for the receivers in case of an erroneous and/or accidental send. |

1.

Select a row of a previously sent document and

click on the Edit button

to hide the document and associated attachments.

to hide the document and associated attachments.

2. Select the Hide Content option and click on Update to hide the Forecast document.

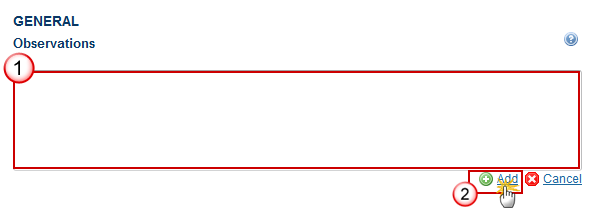

Observations

This section is to provide any relevant information to the Quarterly Declaration of Expenditure. It can be used as a chat between the (Candidate) MS and the Commission.

1. Enter the following:

Enter an observation.

All users who have Read permission on the DOE will be able to read all Observations in the conversation.

Click on Add to save the information.

All Observations are kept against the specific version of the DOE.

Declaration

|

Remark |

The submission of the first version of the DOE to EC must occur before the end of the corresponding Declaration Period. In case the DOE is returned for modification by EC, the new version can be resubmitted to EC even after the end of the corresponding Declaration Period. A scheduling module will generate the following events which will be propagated by the notification module: · At the first day of the Declaration Period generate event "Beginning of Declaration Period for YYYYQN" · At the 20th day of the Declaration Period generate event "Declaration YYYYQN is missing" · Every day between the 25th and the last day of the Declaration Period generate event "Declaration YYYYQN is still missing and Declaration Period will be closed at dd/mm/yyyy". |

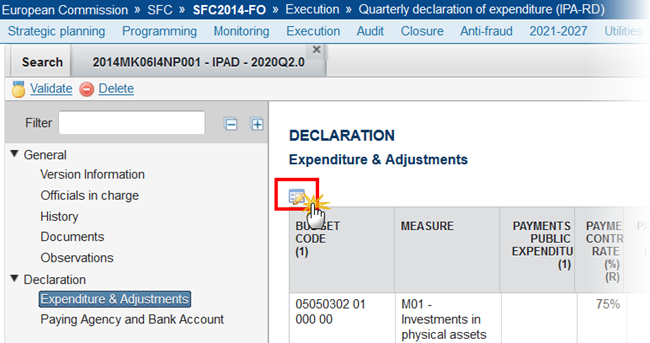

Expenditure & Adjustments

1.

Click on the Edit button  to start adding the required

information.

to start adding the required

information.

The Table becomes editable.

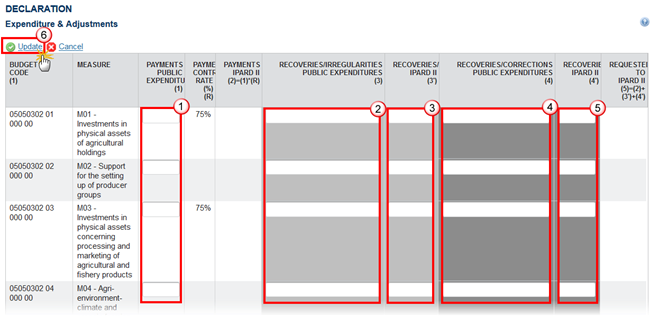

2. Enter the following:

Enter the values (EUR) for the fields in the column PAYMENTS PUBLIC EXPENDITURE

Enter the values (EUR) for the fields in the column RECOVERIES/ IRREGULARITIES PUBLIC EXPENDITURE

Enter the values (EUR) for the fields in the column RECOVERIES/ IRREGULARITIES IPARD II

Enter the values (EUR) for the fields in the column RECOVERIES/ CORRECTIONS PUBLIC EXPENDITURE

Enter the values (EUR) for the fields in the column RECOVERIES/ CORRECTIONS IPARD II

Click Update or cancel to save the data or cancel the action.

Totals are automatically computed by the system

|

NOTE |

Column 1 - BUDGET CODE: Budget Code is generated based on the selected Measures in the Financing Plan of the linked IPARD Programme Column 2 - MEASURE: Applicable Measure automatically generated. Column 3 - PAYMENTS PUBLIC EXPENDITURE (1): "Public expenditure incurred during the quarter (EUR)". Amount manually entered must be positive Column 4 - PAYMENTS CONTRIBUTION RATE (R): Automatically generated. "Contribution Rate in force (%)" is the contribution rate pertaining to the decision in force the first day of the quarter. Colum 5 - PAYMENTS IPARD II (2) : "Union Contribution requested amount before corrections" is the total Union Contribution amount before corrections and calculated as follow: (2) = (1) * (R) (rounded to 2 decimals). Values are computed. Column 6 - RECOVERIES/ IRREGULARITIES PUBLIC EXPENDITURE (3): Amount in EUR manually entered for Recoveries / Irregularities ( Public Expenditures). Column 7 - RECOVERIES/ IRREGULARITIES IPARD II (3’): Amount in EUR manually entered for Recoveries/Irregularities( IPARD II) Column 8 - RECOVERIES/ CORRECTIONS PUBLIC EXPENDITURE (4): Amount in EUR manually entered for Recoveries/Corrections (Public Expenditures). Column 9 - RECOVERIES/ CORRECTIONS IPARD II (4’): Amount in EUR manually entered for Recoveries/Corrections (IPARD II) Column 10 – REQUESTED TO IPARD II (5) = (2) + (3') +(4'): Computed amount requested to IPARD II (5) = (2) + (3') +(4') |

Paying Agency and Bank Account

1.

Click on the Edit button  to start adding the required

information.

to start adding the required

information.

2. Enter the following:

Record the information in the appropriate field.

Click Update or cancel to save the data or cancel the action.

|

Remark |

All information marked as * are mandatory. All information is automatically prefilled by the system from Bank Account information of the previous accepted quarterly declaration (DoE). You can update this prefilled information. Designated body code (= PA code + PA name) is copied from the previous Declaration only if it is still valid otherwise you are invited to select the new Designated body code among the list of valid ones. The list of ‘designated body code’ contains all valid paying agencies for the country of the CCI. |

Validate the Quarterly Declaration of Expenditure (IPA-RD)

1. Click on the Validate link to validate the Quarterly Declaration of Expenditure.

The system validates the following information:

|

Remark |

An Error will block you from sending the Quarterly Declaration of Expenditure. The error(s) should be resolved and the Quarterly Declaration of Expenditure must be revalidated. Note that a Warning does not block you from sending the Quarterly Declaration of Expenditure. |

|

CODE |

VALIDATION RULES |

SEVERITY |

|

|

The quarterly DOE version has been validated |

INFO |

|

228 |

Validate that at least one (Candidate) Member State Official in Charge exists. |

Warning |

|

502 |

Validate that all integral documents must have at least one attachment. |

ERROR |

After all errors have been resolved the status of the Quarterly Declaration of Expenditure becomes 'Ready to send'.

An example of a validation window:

Send the Quarterly Declaration of Expenditure (IPA-RD)

|

Remark |

The Quarterly Declaration of Expenditure can only be sent once the Validation Errors have been removed and the status is 'Ready to Send'. It is a must to have the privilege to send the Quarterly Declaration of Expenditure. The "4 eyes principle" must be respected. Therefore, the user sending must be different from the user who last validated. |

1. Click on the Send link to send the Quarterly Declaration of Expenditure to the Commission or to an upper Node.

The system will ask you to confirm the send action:

2. Click on 'Yes' to confirm.

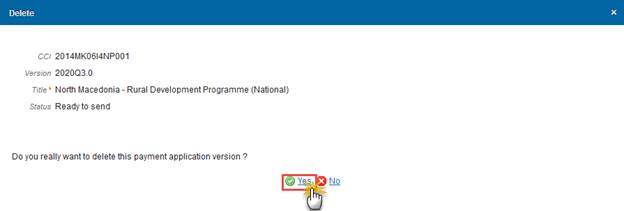

Delete the Quarterly Declaration of Expenditure (IPA-RD)

|

Remark |

A Quarterly Declaration of Expenditure can be deleted when the status is 'Open', 'Ready to send' or 'Returned for modification by MS', and has never been sent to the Commission before and has no sent documents attached. |

1. Click on the Delete link to remove the Quarterly Declaration of Expenditure from the system.

The system will ask you to confirm the delete action:

2. Click on 'Yes' to confirm or click on 'No' to return to the Declaration of Expenditure.

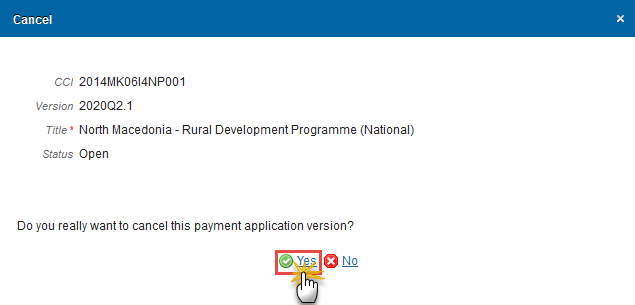

Cancel the Quarterly Declaration of Expenditure (IPA-RD)

|

Remark |

A Quarterly Declaration of Expenditure can be cancelled when the status is 'Open' or 'Ready to send' or 'Returned for modification by MS' before it reaches an 'Acceptance' and has documents sent to the Commission or has a previous working version 'Returned for Modification by the Commission'. |

3. Click on the Cancel link to remove the Quarterly Declaration of Expenditure from the system.

The system will ask you to confirm the cancel action:

4. Click on 'Yes' to confirm or click on 'No' to return to the Quarterly Declaration of Expenditure.

The Quarterly Declaration of Expenditure has been cancelled and its status was set to 'Cancelled'.

Create a New Version of a Quarterly Declaration of Expenditure (IPA-RD)

|

Remark |

A new version of the Quarterly Declaration of Expenditure can be created when the last version is in status 'Returned for modification by the Commission' or 'Cancelled'. |

1. Click on the Create new version link to create a new version of the Quarterly Declaration of Expenditure.

The system will ask you to confirm the creation of a new version:

2. Click on 'Yes' to confirm. Click on 'No' to return to the Quarterly Declaration of Expenditure.

Early Warning Notification

The submission of the first version of the DOE to EC must occur before the end of the corresponding Declaration Period. In case the DOE is returned for modification by EC, the new version can be resubmitted to EC even after the end of the corresponding Declaration Period.

A scheduling module will generate the following events which will be propagated by the notification module:

· At the first day of the Declaration Period an email will be sent: "Beginning of Declaration Period for YYYYQN"

· At the 20th day of the Declaration Period an email notification will be sent: "Declaration YYYYQN is missing"

· Every day between the 25th and the last day of the Declaration Period, an email notification will be sent to the (Candidate) Member State and it will say:

"Declaration YYYYQN is still missing and Declaration Period will be closed at dd/mm/yyyy".