Quarterly Declaration of Expenditure (EAFRD)

PURPOSE

This document describes the specifications and details related to Quarterly Declaration of Expenditure for EAFRD. The main objective of this module is to allow Member State Paying Agency/Coordination Body to declare – during a limited period - eligible amount expenditure for which it has actually paid the corresponding EAFRD contribution during the quarter and referenced as Q1 to Q4 YYYY.

REGULATIONS

More detail regarding the regulation of the Quarterly Declaration of Expenditure can be found in About SFC2014 section of this portal.

ROLES

Roles involved in the Quarterly Declaration of Expenditure for EAFRD are:

MS Accredited Paying Agency MS Coordination Body | Create Quarterly Declaration of Expenditure Record/Edit Quarterly Declaration of Expenditure Upload Quarterly Declaration of Expenditure Documents Consult Quarterly Declaration of Expenditure Validate Quarterly Declaration of Expenditure Send Quarterly Declaration of Expenditure Delete Quarterly Declaration of Expenditure Cancel Quarterly Declaration of Expenditure Return Quarterly Declaration of Expenditure Create New Version of Quarterly Declaration of Expenditure |

MS Managing Authority MS Audit Authority | Consult Quarterly Declaration of Expenditure |

FUNDS

EAFRD |

|

|

|

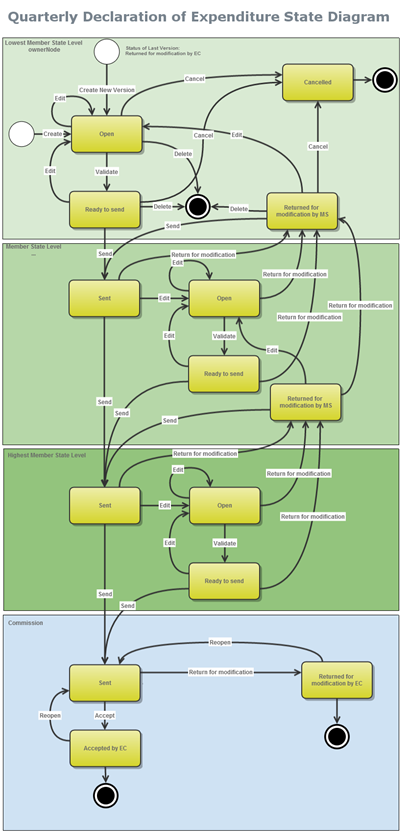

Workflow

This section shows the lifecycle to create and manage a Quarterly Declaration of Expenditure.

Click here to see the QDOE workflow diagram in high resolution.

Create a Quarterly Declaration of Expenditure (EAFRD)

Remark | A Rural Development Programme must be 'Adopted by EC' before a Quarterly declaration of Expenditure can be created. It is a must to have the role of the ‘MS Accredited Paying Agency’ OR ‘MS Coordination Body’ with Update access. |

1. To access the Quarterly Declaration of Expenditure section first click on the "Execution" menu and then on the "Quarterly Declaration of Expenditure (EAFRD)" link.

2. Click on the Create new Quarterly Declaration of Expenditure (EAFRD) link to create a new Quarterly Declaration of Expenditure.

You are redirected to the Quarterly Declaration of Expenditure creation wizard:

3. Select or enter the following information:

Select the CCI code from the drop-down menu.

The CCI list contains all adopted Programmes (last adopted version present at the first date of the Expenses Period) managed on your Node(s) and which contain Funds for which you are registered.

The Version (=year and quarter) are selected by default.

REMARK | The Quarterly Declaration of Expenditure can only be created and submitted during the month following the Expenditure Period. Therefore the Expenditure Period is automatically set by the system. Expenses occurred during: · The first Quarter (YYYYQ1 = 01/01/YYYY to 31/03/YYYY) can only be created from Declaration Period 01/04/YYYY to 30/04/YYYY. · The second Quarter (YYYYQ2 = 01/04/YYYY to 30/06/YYYY) can only be created from Declaration Period 01/07/YYYY to 31/07/YYYY. · The third Quarter (YYYYQ3 = 01/07/YYYY to 15/10/YYYY) can only be created from Declaration Period 16/10/YYYY to 10/11/YYYY. · The fourth Quarter (YYYYQ4 = 16/10/YYYY to 31/12/YYYY) can only be created from Declaration Period 01/01/YYYY+1 to 31/01/YYYY+1. Exception, in case of the first declaration the start Expenditure Period is always 01/01/2014 |

Declaration Type is by default selected as "Interim".

The (Expenditure) period is defined by the system.

Disclaimer: in case of first declarations

Ask for the benefit of Art 24 of Reg.(EU) No 1303/2013: (Increase in payments for Member state with temporary budgetary difficulties). A Member State with temporary budgetary difficulties may request the increase by 10 percentage points above the co-financing rate applicable to each measure. The increased rate may not exceed 100%.

A National Reference for this declaration can be added (not mandatory)

Click on 'Finish'.

The status of the Declaration of Expenditure is now Open.

Remark | · The Quarterly Declaration of Expenditure is linked to the last adopted version of the Rural Development Programme present at the first date of the Expenditure Period. The first Quarterly Declaration of Expenditure will be linked to the last adopted version of the Rural Development Programme present at the creation date of the Quarterly Declaration of Expenditure. · On Create, The structure of a DOE: Budget code and Priority/FA is based on the Financial Plan in force the last day of the Expenditure period. · For each Budget code, the EAFRD contribution rate is the applicable rate of the Financial Plan in force the first day of the same Expenditure period. In case this applicable rate doesn’t exist in the Financing Plan in force the first day of the expense period (new measure, new type of region/derogation), the EAFRD contribution rate will be the applicable rate of the Financial Plan in force the last day of the expense period. · The DOE is linked to the last adopted version (version in force) of the Rural Development Programme present the first day of the Expenditure Period. The first DOE will be linked to the last adopted version (version in force) of the Rural Development Programme present at the creation date of the DOE. · The display of the budget codes were added until Q3 to allow Member States to declare any adjustments to the amounts previously declared or irregularities (Article 22(5) of Reg. 908/2014). For these historical budget lines, only columns 7 and 8 were enabled and column 4 was blocked: 1) "Where budget codes have been removed from the Financing Plan during the financial year (YYYY-1Q4 to YYYYQ3) those codes should nevertheless remain available in the Declaration of Expenditure until Q3 of the same FY to allow Member States to declare any adjustments to the amounts previously declared or irregularities (Article 22(5) of Reg. 908/2014). For these historical budget lines, only columns 7 and 8 should be enabled; column 4 should be blocked." 2) At the beginning of a new financial year (for the Q4 declaration), all budget codes that do not exist in the Financing Plan in force on the 31st December should be excluded from the declaration. There should be no possibility for the MS to declare adjustments to the expenditure or assigned revenue declared in a previous financial year · Ask for the benefit of Art 24 of Reg.(EU) No 1303/2013: A Member State with temporary budgetary difficulties may request the increase by 10 percentage points above the co-financing rate applicable to each measure. The increased rate may not exceed 100%. Value by default of Art 24 of Regulation (EU) No 1303/2013 is not applicable. The benefit of Art 24 applies to requests for payments for the period until 30 June 2016 (until 2016Q3 included). · In case of first declaration, the following disclaimer must be displayed in the creation screen in order to inform the MS that in case of the first declaration the start Expenditure Period is always 01/01/2014: This disclaimer must also be displayed in the 'Version Information' screen and in the cover page of the snapshot/ack report: "Art.22(2) of Reg.(EU) No 908/2014 - All expenditure paid by paying agencies to the beneficiaries in accordance with Article 65(2) of Regulation (EU) No 1303/2013 prior to the approval of a rural development programme as referred to in Article 6 of Regulation (EU) No 1305/2013 is made under the Member States' responsibility and shall be declared to the Commission in the first declaration of expenditure following the adoption of that programme" · Adjustment in Q4 Since Q4 is the first Quarter of the financial year, there are no adjustments to be made in relation to previous Quarters (Article 22(5) of Reg. 908/2014). Consequently, there should be no declared amounts in columns 8 and 8' for Q4. In practice, however, this is not the case. There have been numerous cases where amounts were declared in columns 8 and 8' in Q4, which necessitates introducing a warning for MS when filling in these columns for Q4. (Experience shows that some of those differences relate to rounding differences between SFC and MS IT systems, which cannot be avoided.) Also, in some cases MS have declared in Q4 positive amounts in columns 7 and 7'. This would indicate that a MS is making corrections to the irregularities relating to previous financial year(s). There should also be a warning message to MS in these cases. |

New budget nomenclature

· For EAFRD (2014-2022) we changed from 05 04 60 01 to 08 03 01 02

o SFC2014 budget code structure: 08030102 MM RRR PP (the first R can be 1/2/3/4/5).

· For EURI the new budget item is 08 03 01 03

o SFC2014 budget code structure: 08030103 MM RRR PP

o The first R in the RRR code also indicates that the budget code is a EURI code (R = 6/7/8/9).

Clarification on what the first digit R in RRR represents:

First digit (R) | Article (1) | Category of contribution rates |

1 | 59(3)(a) | Less developed regions, outermost regions and in the smaller Aegean islands within the meaning of Regulation (EU) No 229/2013 |

2 | 59(3)(b) | Regions whose GDP per capita for the 2007-2013 programming period was less than 75 % of the average of the EU-25 for the reference period but whose GDP per capita is above 75 % of the GDP average of the EU-27 |

3 | 59(3)(c) | Transition regions other than those referred to in Article 59(3)(b) of Regulation (EU) No 1305/2013 |

4 | 59(3)(d) | Other regions |

5 | — | Discontinued measure |

6 | 59(3)(a) + 59(4)(ea) | Less developed regions, outermost regions and in the smaller Aegean islands within the meaning of Regulation (EU) No 229/2013 – EURI, Operations receiving funding from additional resources referred to in Article 58a(1) |

7 | 59(3)(b) + 59(4)(ea) | Regions whose GDP per capita for the 2007-2013 programming period was less than 75 % of the average of the EU-25 for the reference period but whose GDP per capita is above 75 % of the GDP average of the EU-27 – EURI, Operations receiving funding from additional resources referred to in Article 58a(1) |

8 | 59(3)(c) + 59(4)(ea) | Transition regions other than those referred to in Article 59(3)(b) of Regulation (EU) No 1305/2013 – EURI, Operations receiving funding from additional resources referred to in Article 58a(1) |

9 | 59(3)(d) + 59(4)(ea) | Other regions – EURI, Operations receiving funding from additional resources referred to in Article 58a(1) |

(1) Reference is made to the respective Article of Regulation (EU) No 1305/2013. | ||

Late Payments

IACS Late Payments

When creating late payments, the Budget codes related to IACS will be added to the quarterly DOE depending on the measures present in the quarterly DOE and also depending on the year of this quarterly DOE.

Case 1: Measures solely IACS: Measures 11, 12, 13 and 14

For each Budget code (BC), except Financial Instruments BC (59(4)(c); 59(4)(d) and 59(4)(h), related to these measures and already created through

- BC from FP first day

- BC from FP last day

- BC from previous DOE removed from FP

A new similar BC will be created except that the 2 digits standing for the measure will be modified as following:

Claim year | 2018, or earlier | 2019 | 2020 | 2021 | 2022 | 2023 |

From DOE |

| 2019 Q3 | 2020 Q3 | 2021 Q3 | 2022 Q3 | 2023 Q3 |

Measure | M11 | M31 | M41 | M51 | M61 | M71 |

M12 | M32 | M42 | M52 | M62 | M72 | |

M13 | M33 | M43 | M53 | M63 | M73 | |

M14 | M34 | M44 | M54 | M64 | M74 |

Example for measure content of a DOE for M12 depending quarters

Until the quarterly DOE 2019Q2

Budget code | Quarter Expenditure | Financial Adjustment | Others Adjustment |

08030102 12 111 00 | OK | OK | OK |

From the quarterly DOE 2019Q3

Budget code | Quarter Expenditure | Financial Adjustment | Others Adjustment |

08030102 12 111 00 | OK | OK | OK |

08030102 32 111 00 | OK | OK | OK |

From the quarterly DOE 2020Q3

Budget code | Quarter Expenditure | Financial Adjustment | Others Adjustment |

08030102 12 111 00 | OK | OK | OK |

08030102 32 111 00 | OK | OK | OK |

08030102 42 111 00 | OK | OK | OK |

(…)

From the quarterly DOE 2023 Q3

Budget code | Quarter Expenditure | Financial Adjustment | Others Adjustment |

08030102 12 111 00 | OK | OK | OK |

08030102 32 111 00 | OK | OK | OK |

08030102 42 111 00 | OK | OK | OK |

08030102 52 111 00 | OK | OK | OK |

08030102 62 111 00 | OK | OK | OK |

08030102 72 111 00 | OK | OK | OK |

Case 2: Measures mixed IACS and non-IACS: Measures 8, 10, 15 and 19

For each Budget codes (BC) except Financial Instruments BC (59(4)(c); 59(4)(d) and 59(4)(h), related to these measures and already created through

- BC from FP first day

- BC from FP last day

- BC from previous DOE removed from FP

A new similar BC will be created except that the 2 digits standing for the measure will be modified as following:

Claim year | 2018, or earlier | 2019 | 2020 | 2021 | 2022 | 2023 | |||||

Expen-diture | IACS + non-IACS | Non-IACS | IACS | Non-IACS | IACS | Non-IACS | IACS | Non-IACS | IACS | Non-IACS | IACS |

Measure | M08 | M08 | M37 | M08 | M47 | M08 | M57 | M08 | M67 | M08 | M77 |

M10 | M10 | M30 | M10 | M40 | M10 | M50 | M10 | M60 | M10 | M70 | |

M15 | M15 | M35 | M15 | M45 | M15 | M55 | M15 | M65 | M15 | M75 | |

M19 | M19 | M39 | M19 | M49 | M19 | M59 | M19 | M69 | M19 | M79 | |

Example for measure content of a DOE for M08 depending quarters

Until the quarterly DOE 2019Q2

Budget code | Quarter Expenditure | Financial Adjustment | Others Adjustment |

08030102 08 111 00 | OK | OK | OK |

From the quarterly DOE 2019Q3

Budget code | Quarter Expenditure | Financial Adjustment | Others Adjustment |

08030102 08 111 00 | OK | OK | OK |

08030102 37 111 00 | OK | OK | OK |

From the quarterly DOE 2020Q3

Budget code | Quarter Expenditure | Financial Adjustment | Others Adjustment |

08030102 08 111 00 | OK | OK | OK |

08030102 37 111 00 | OK | OK | OK |

08030102 47 111 00 | OK | OK | OK |

(...)

From the quarterly DOE 2023 Q3

Budget code | Quarter Expenditure | Financial Adjustment | Others Adjustment |

08030102 08 111 00 | OK | OK | OK |

08030102 37 111 00 | OK | OK | OK |

08030102 47 111 00 | OK | OK | OK |

08030102 57 111 00 | OK | OK | OK |

08030102 67 111 00 | OK | OK | OK |

08030102 77 111 00 | OK | OK | OK |

Deleting/Adding measures/budget codes

If a budget code is deleted from the Financing Plan in force the last day of the quarter, it means that it will appear in blue in the next declaration of expenditure of the same financial year. For these blue codes in Q3 (this is when we add the late payment codes every year for the new claim year), we will not add the measure/budget codes that would add for the new claim year.

For the blue codes in Q3, we recreate what existed before but we do not create the codes for the new claim years.

Sections of both cases on SFC DOE and RDP-Financing Plan screens:

Example for measure content of a DOE for M08 depending quarters

Until the quarterly DOE 2019Q2

Budget code | Quarter Expenditure | Financial Adjustments | Other Adjustments |

08030102 08 111 00 | OK | OK | OK |

From the quarterly DOE 2019Q3

Budget code | Quarter Expenditure | Financial Adjustments | Other Adjustments |

08030102 08 111 00 | OK | OK | OK |

08030102 37 111 00 | OK | OK | OK |

è RDP Amendment just before sending declaration for 2020Q2 – measure/budget codes deleted for M08

From the quarterly DOE 2020Q2

Budget code | Quarter Expenditure | Financial Adjustments | Other Adjustments |

08030102 08 111 00 | - | OK | OK |

08030102 37 111 00 | - | OK | OK |

(...)

From the quarterly DOE 2020Q3

Budget code | Quarter Expenditure | Financial Adjustments | Other Adjustments |

08030102 08 111 00 | - | OK | OK |

08030102 37 111 00 | - | OK | OK |

We do not add: 08030102 47 111 00 |

|

|

|

From the quarterly DOE 2020Q4

Budget code | Quarter Expenditure | Financial Adjustments | Other Adjustments |

All codes that are in blue are deleted |

|

|

|

Adding measures/Budget Codes in the Financing Plan:

When a new measure/Budget Code is added in the Financial Plan, the related IACS Budget Codes are also added for all previous claim years, not only the ones for the current/following claim year.

A financial rule (warning) could also be added during the validation of the DOE in order to inform the Member State that they are declaring in IACS Budget Codes from previous calendar years.

In the sections ‘Declaration - Expenditure & Adjustments’ of the Quarterly DOE and ‘Breakdown by measure’ in the RDP-Financing Plan, the numbering of the measures will remain the same. The new measure codes will not appear in the title of each measure but only in the detailed part of the measure ‘Types of Regions and additional allocations/budget code’.

The contribution rate for the new measure code should be the same as the initial measure.

Budget codes in columns ‘Types of Regions and additional allocations/budget code’ section should be sorted according to the derogation combinations.

Sorting by derogation combinations – Measure 08:

08030102 08 111

08030102 37 111

08030102 08 121

08030102 37 121

08030102 08 122

08030102 37 122

In the summary table 'Expenditure & Adjustments', the amounts should be aggregated under the original measure. For instance for M08, only M08 will be displayed in the table and will contain the sum of the amounts for M08 +M37 +M47 +M57 +M67 + M77.

Record/Edit the Quarterly Declaration of Expenditure (EAFRD)

Remark | When editing a version of a Quarterly Declaration of Expenditure, its status is 'Open', 'Ready to send' or 'Sent' at the level of the Member State and currently resides on the user's level. |

Find all the information to complete each screen of the Quarterly Declaration of Expenditure. Below are the links to the main sections:

· General

General

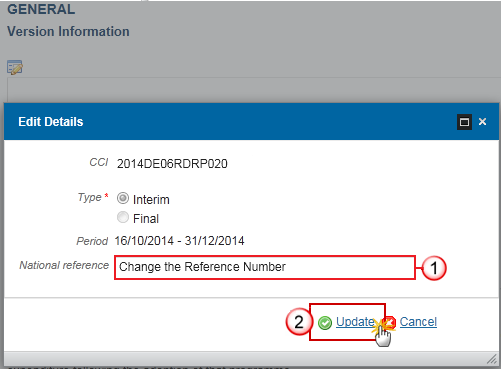

Version Information

The version information contains information on the identification and status of the DOE Version like the CCI, the Title, the Type, the Fund, the Version Number, the Status, the Node where it currently resides and the Accounting Period. It also shows the results of the last validation done on this DOE version.

The Version information for the Quarterly Declaration of Expenditure cannot be modified once the version has been created; only the applicably of Art 24 of Regulation (EU) N° 1303/2013 and the National Reference can be updated.

1. Click on the Edit Button  to modify the information.

to modify the information.

2. Enter the following information:

Enter the National Reference.

Click on Update to update the information.

Only the applicably of Art 24 of Regulation (EU) No 1303/2013 and the National Reference can be updated.

The display will also contain a Print link allowing generating a PDF version. It can be used to verify what has been entered in the system and what has been modified compared to any previous version of the same Expenditure Period and will by default show the previous version.

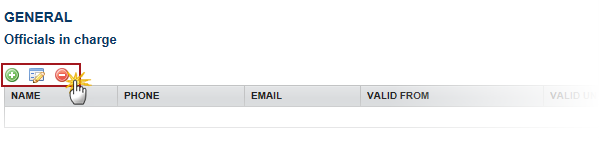

Officials in Charge

Note | Officials in Charge can be updated at any time, independent from the status of the Quarterly Declaration of Expenditure. |

· Click on the Add button  to add a new official in charge.

to add a new official in charge.

· Select an official and click in the Edit button  to modify the information of this official.

to modify the information of this official.

· Select an official and click on the Remove button  to delete the official in charge selected.

to delete the official in charge selected.

1. Click on the Add button  to add a new official in charge

to add a new official in charge

2. Enter the following information:

Enter the Name.

Enter the Email.

Click on Update to save the information.

Note | Commission Officials (email domain "ec.europa.eu") can only be created/updated/deleted by Commission Users. The email is directly accessible via the email link. |

History

This section shows all the actions that happened in the Quarterly Declaration of Expenditure since it was created and the resulting status, for example:

The email of the user is directly accessible via the email link.

Documents

The following documents list will be foreseen:

Description | Non-Integral | Integral | System | Required |

Other Member State Document | X |

|

|

|

Other adjustments justification | X |

|

|

|

Request to withdraw payment application | X |

|

|

|

Other Adjustments Justification* |

| X |

|

|

Snapshot of data before send |

| X | X | X |

*Only if negative amounts are provided for other adjustments

Uploading & Sending Documents

Multiple documents can be uploaded in the Quarterly Declaration of Expenditure.

· Clicking on the Add button  will open a pop up window allowing you to add a new document type with attachments.

will open a pop up window allowing you to add a new document type with attachments.

· Selecting a document row and click in the Edit button will allow you to modify the document information. If a document of type 'Other Member State Document' must be sent, you can select the edit button in order to send the document.

will allow you to modify the document information. If a document of type 'Other Member State Document' must be sent, you can select the edit button in order to send the document.

Remark | Referential Documents (ie. 'Other Member State Document') can be sent at any time independently of the status of the Quarterly Declaration of Expenditure. A document is only visible to the Commission when the sent date is visible:

|

1. Click on the Add button  to add a new document.

to add a new document.

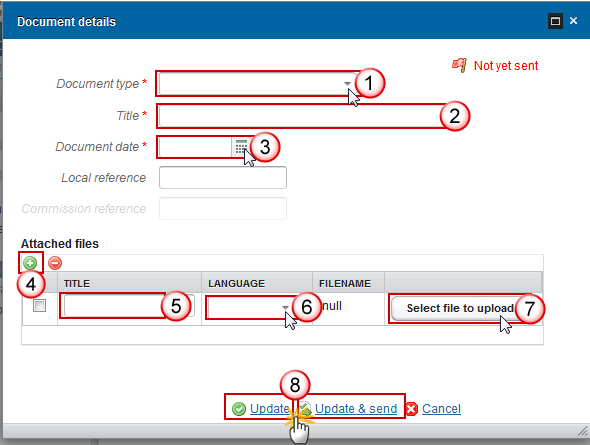

The document details pop-up window appears:

2. Enter or select the following information:

Select a Document Type

Enter a title for your Document

Enter a Document Date

Click on the Add button  to add a new attachment

to add a new attachment

· You can add multiple attachments by clicking on the Add button

· You can remove unwanted attachments by selecting the attachment and clicking on the Remove button

Enter a Title for your attachment.

Select the Language of the document.

Select the file to upload.

Click on Update to save the information or Update & Send to send the document to the Commission.

Remark | Commission Registration N° is only enabled for Commission Users, while Local Reference is only enabled for Member State Users. |

The pop-up window closes and the documents are uploaded:

Sending an unsent non-integral document

1. To send a non-integral document that is not yet sent: once the document and attachment(s) have been uploaded select the document row in the list and click on the Edit button :

:

2. Click on Update & Send to send the document to the Commission.

Note | The "Update & Send" button will only be shown for documents which are not integral part of the Quarterly Declaration of Expenditure and after at least one attachment was added. |

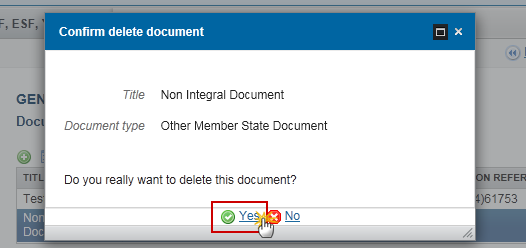

Deletion of an unsent document

Remark | Only documents that have not yet been sent to the Commission can be deleted. |

1. Select a row of a previously uploaded document and click on the Remove button  to delete the document and associated attachments.

to delete the document and associated attachments.

A confirmation window appears:

2. Click on 'Yes' to confirm deletion. Click on 'No' to return to the Quarterly Declaration of Expenditure documents.

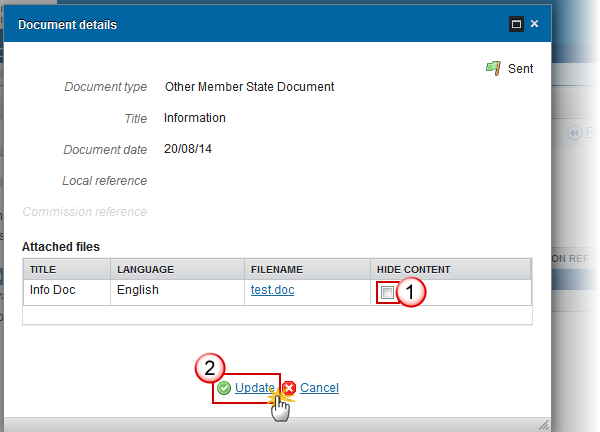

Hiding a sent document

Note | Sent Documents can never be deleted, but the sender can decide to hide the content for the receivers in case of an erroneous and/or accidental send. |

1. Select a row of a previously sent document and click on the Edit button  to hide the document and associated attachments.

to hide the document and associated attachments.

2. Select the Hide Content option and click on Update to hide the Forecast document.

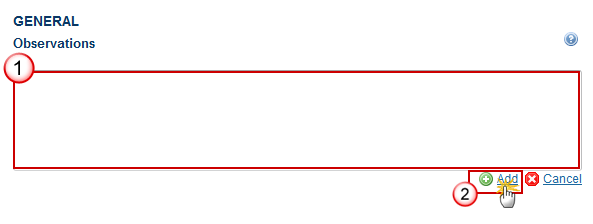

Observations

This section is to provide any relevant information to the Quarterly Declaration of Expenditure. It can be used as a chat between the MS and the Commission.

1. Enter the following:

Enter an observation.

All users who have Read permission on the DOE will be able to read all Observations in the conversation.

Click on Add to save the information.

All Observations are kept against the specific version of the DOE.

Declaration

Remark | The submission of the first version of the DOE to EC must occur before the end of the corresponding Declaration Period. In case the DOE is returned for modification by EC, the new version can be resubmitted to EC even after the end of the corresponding Declaration Period. A scheduling module will generate the following events which will be propagated by the notification module: · At the first day of the Declaration Period generate event "Beginning of Declaration Period for YYYYQN" · At the 20th day of the Declaration Period generate event "Declaration YYYYQN is missing" · Every day between the 25th and the last day of the Declaration Period generate event "Declaration YYYYQN is still missing and Declaration Period will be closed at dd/mm/yyyy". |

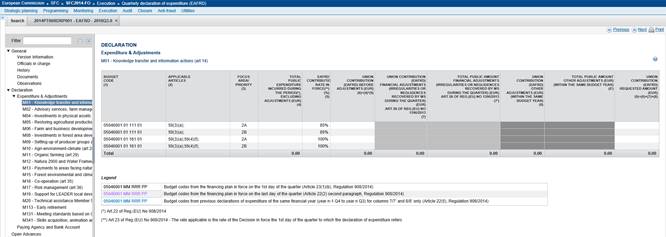

Expenditure & Adjustments

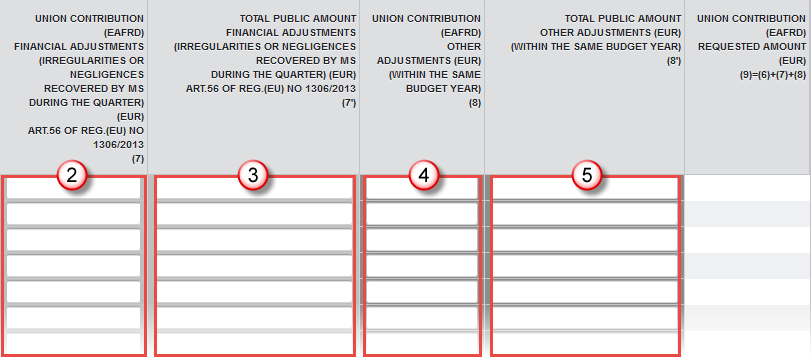

Remark | Quarterly Declaration of Expenditure for and correction to apply to Public expenditure as provided in with Article 56 of regulation (EU) N° 1306/2013 – by Measure. Expenditure & Adjustments structure The structure (budget codes) of the section Expenditure & Adjustments depends on the financial plan structure of the adopted programme linked to this declaration. Co-financing rates The different co-financing rates are also retrieved from the financial plan of the adopted programme linked to this declaration; Co-financing rates are increased by 10% up-to 100% if the MS asked for the benefit of Art 24 of Reg.(EU) No 1303/2013 during the creation of the declaration Budget codes On Create, The structure of a DOE: Budget code and Priority/FA is based on the Financial Plan in force the last day of the Expenditure period. For each Budget code, the EAFRD contribution rate is the applicable rate of the Financial Plan in force the first day of the same Expenditure period. In case this applicable rate doesn’t exist in the Financing Plan in force the first day of the expense period (new measure, new type of region/derogation), the EAFRD contribution rate will be the applicable rate of the Financial Plan in force the last day of the expense period. The display of the budget codes were added until Q3 to allow Member States to declare any adjustments to the amounts previously declared or irregularities (Article 22(5) of Reg. 908/2014). For these historical budget lines, only columns 7 and 8 were enabled and column 4 was blocked: 1) "Where budget codes have been removed from the Financing Plan during the financial year (YYYY-1Q4 to YYYYQ3) those codes should nevertheless remain available in the Declaration of Expenditure until Q3 of the same FY to allow Member States to declare any adjustments to the amounts previously declared or irregularities (Article 22(5) of Reg. 908/2014). For these historical budget lines, only columns 7 and 8 should be enabled; column 4 should be blocked." 2) At the beginning of a new financial year (for the Q4 declaration), all budget codes that do not exist in the Financing Plan in force on the 31st December should be excluded from the declaration. There should be no possibility for the MS to declare adjustments to the expenditure or assigned revenue declared in a previous financial year. Budget codes structure The budget codes must have the following structure "05046001 MM RRR PP": - The first 8 digits are constant: "05046001". - The following 2 digits "MM" indicate the measure. - The next three digits "RRR" indicate the combination of articles used to establish the maximum EAFRD contribution rate: 1 digit for the 'Category of contribution rates (type of regions)/Discontinued. Measure'; 1 digit for the 'Derogations/Others allocations'; 1 digit for the applicability of articles 59(4)(d)1; 59(4)(g)1 and (24)(1) - The last 2 digits "PP" indicate the programme number The DOE is linked to the last adopted version (version in force) of the Rural Development Programme present the first day of the Expenditure Period. The first DOE will be linked to the last adopted version (version in force) of the Rural Development Programme present at the creation date of the DOE |

1. Select a measure and click on the Edit button  to start adding the required information.

to start adding the required information.

The Edit Expenditure & Adjustments screen appears:

2. Enter the following:

Enter the values (EUR) for the fields in column (4).

Enter the values (EUR) for the fields in column (7).

Enter the values (EUR) for the fields in column (7’).

Enter the values (EUR) for the fields in column (8).

Enter the values (EUR) for the fields in column (8’).

Click Update or cancel to save the data or cancel the action.

Totals are automatically computed by the system

NOTE | Column 1: Budget Code is generated based on the selected Measures and articles for Type of Region and articles for Derogations/other Allocations in the Financing Plan of the linked RDP, having an EAFRD contribution rate higher than 0. It takes also into account the applicability of Art 24 of Reg.(EU) No 1303/2013 · Budget codes displayed in black are the ones from FP the first in force the first day of the expenditures period. · Budget codes displayed in pink are the Budget codes from Financial Plan in force the last day of the expenditures period. · Budget codes displayed in blue are the ones from previous DOE of the same financial year (year n-1 Q4 to year n Q3) for columns 7/7’ and 8/8’ only (Article 22(5), Regulation 908/2014). Column 2: Automatically generated. APPLICABLE ARTICLES: short description of the applicable articles in a Budget Code Column 3: Automatically generated. Focus Area (except those from P1 and P4) or Priority in case of P4. Column 4: TOTAL PUBLIC EXPENDITURE INCURRED DURING THE PERIOD, EXCLUDING ADJUSTMENTS (EUR)" Colum 5: Automatically generated. EAFRD CONTRIBUTION RATE IN FORCE (%)" is the contribution rate pertaining to the Financial Plan in force the first day of the quarter. In case this contribution rate doesn’t exist in the Financing Plan in force the first day of the expense period (new measure, new type of region/derogation), the EAFRD contribution rate will be the applicable rate of the Financial Plan in force the last day of the expense period. Column 6: UNION CONTRIBUTION (EAFRD) REQUESTED AMOUNT BEFORE CORRECTIONS is the total Union Contribution amount before corrections and calculated as follow: (=4*5) rounded to 2 decimals. Column 7: UNION CONTRIBUTION (EAFRD). FINANCIAL ADJUSTMENTS (IRREGULARITIES OR NEGLIGENCES RECOVERED BY MS DURING THE QUARTER (EUR). ART. 56 REG. (EU) NO 1306/2013. Amounts cancelled and recovered during the quarter. Column 7’: TOTAL PUBLIC AMOUNT. FINANCIAL ADJUSTMENTS (IRREGULARITIES OR NEGLIGENCE RECOVERED BY MS DURING THE QUARTER) (EUR) ART.56 OF REG.(EU) NO 1306/2013 Column 8: UNION CONTRIBUTION (EAFRD). TECHNICAL ADJUSTMENTS (EUR) (WITHIN THE SAME BUDGET YEAR) Column 8’: TOTAL PUBLIC AMOUNT. OTHER ADJUSTMENTS (EUR) (WITHIN THE SAME BUDGET YEAR) Column 9: UNION CONTRIBUTION (EAFRD). REQUESTED AMOUNT" =6+7+8 For M12, 'Total Union contribution reserved for operations falling within the scope of (EU) No 1305/2013 Article 59(6)' must also be filled. An aggregated table with the same data by measure must be available by clicking on 'Expenditure & Adjustments’. This table must display also the overall total of the quarterly DOE. Budget codes (in blue) removed from the Financing Plan during the financial year which remain available in the Declaration of Expenditure until Q3 of the same FY to allow Member States to declare any adjustments to the amounts previously declared or irregularities (Article 22(5) of Reg. 908/2014). For these historical budget lines, only columns 7 (and 7') and 8 and (8') should be enabled; column 4 should be blocked and the contribution rate should not be displayed (column 5) "Where budget codes have been removed from the Financing Plan during the financial year (YYYY-1Q4 to YYYYQ3) those codes should nevertheless remain available in the Declaration of Expenditure until Q3 of the same FY to allow Member States to declare any adjustments to the amounts previously declared or irregularities (Article 22(5) of Reg. 908/2014). For these historical budget lines, only columns 7 and 8 should be enabled; column 4 should be blocked." Starting from 2018Q3, For budget codes referring to Article 59(4)(g) you can only declare irregularities (columns 7,7'). Modifications of expenditure are not allowed anymore.

Since Q4 is the first Quarter of the financial year, there are no adjustments to be made in relation to previous Quarters (Article 22(5) of Reg. 908/2014). Consequently, there should be no declared amounts in columns 8 and 8' for Q4. In practice, however, this is not the case. There have been numerous cases where amounts were declared in columns 8 and 8' in Q4, which necessitates introducing a warning for MS when filling in these columns for Q4. (Experience shows that some of those differences relate to rounding differences between SFC and MS IT systems, which cannot be avoided.) Also, in some cases MS have declared in Q4 positive amounts in columns 7 and 7'. This would indicate that a MS is making corrections to the irregularities relating to previous financial year(s). There should also be a warning message to MS in these cases. |

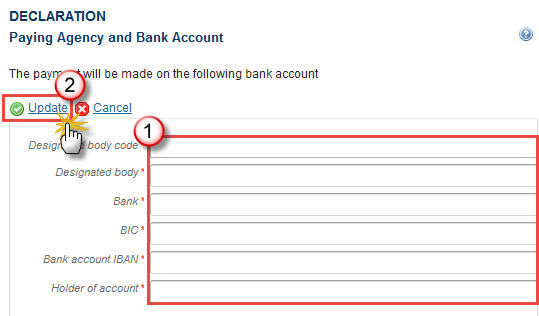

Paying Agency and Bank Account

1. Click on the Edit button  to start adding the required information.

to start adding the required information.

2. Enter the following:

Record the information in the appropriate field.

Click Update or cancel to save the data or cancel the action.

Remark | All information marked as * are mandatory. All information is automatically prefilled by the system from Bank Account information of the previous accepted quarterly declaration (DoE). You can update this prefilled information. Designated body code (= PA code + PA name) is copied from the previous Declaration only if it is still valid otherwise you are invited to select the new Designated body code among the list of valid ones. The list of ‘designated body code’ contains all valid paying agencies for the country of the CCI. |

Financial Instruments

Information on programme contributions paid to Financial Instruments as referred to in article 41 of regulation (EU) No 1303/2013 and included in the quarterly payment application.

Remark | This section is displayed only when 'Article 59(4)(d) of Regulation (EU) No 1305/2013' or Information on programme contributions paid to financial instruments as referred to in Art. 41 Reg (EU) NO 1303/2013 and included in the quarterly payment application (CF Appendix 1 of Commission Implementing regulation (EU) N° 1011/2014 laying down detailed rules for implementing regulation (EU) N° 1303/2013). Financial Instruments table structure The structure (Budget codes) of the Financial Instruments table depends on the financial plan structure of the adopted programme linked to this declaration. The budget codes of this table are generated and aggregated at the level of the Type of Region, based on budget codes present in the Financial Plan in force the first day of the period, , having an EAFRD contribution higher than 0. Technical Assistance (M20) and Discontinued Measures (M113; M131;M341) are not subject to "Financial instruments" therefore these measures are not included in this table Budget code structure The budget codes must have the following structure "05046001 MM RRR PP": - The first 8 digits are constant: "05046001". - The following 2 digits "MM" indicate the measure. - The next three digits "RRR" indicate the combination of articles used to establish the maximum EAFRD contribution rate: 1 digit for the 'Category of contribution rates (type of regions)/Discontinued. Measure'; 1 digit for the 'Derogations/Others allocations'; 1 digit for the applicability of articles 59(4)(d)1; 59(4)(g)1 and (24)(1) - The last 2 digits "PP" indicate the programme number |

1. Click on the Edit button  to start adding the required information.

to start adding the required information.

The Edit Financial Instruments screen appears:

2. Enter the following:

Record the information in the appropriate field.

Click Update or cancel to save the data or cancel the action.

Remark | Budget Codes are generated based on the selected Measures (except M20 and discontinued Measures) in the Financing Plan of linked RDP, having an EAFRD contribution higher than 0. M20 of NRN is not subject to “Financial instruments” therefore this section is not applicable for a DOE linked to a NRN Programme. The column TOTAL AMOUNT OF PROGRAMME CONTRIBUTIONS PAID TO FINANCIAL INSTRUMENTS (EUR) (3) is automatically calculated based on the Financial Instrument expenditure (59(4)(d) and 59(4)(h) declared by measure (section Expenditure & Adjustments). |

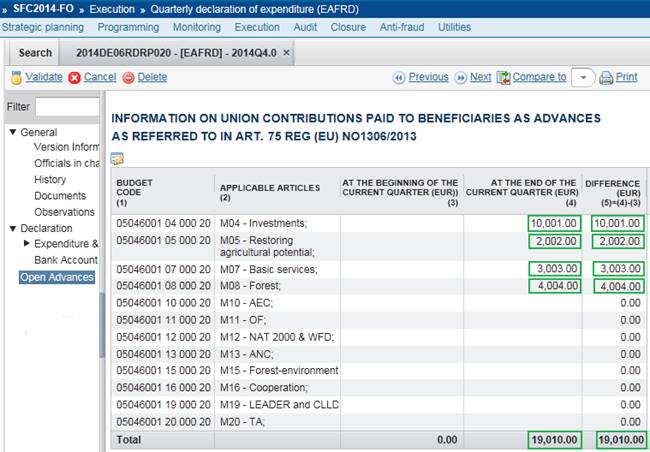

Open Advances

Open Advances still to be cleared

Remark | Declaration structure The structure (budget codes) of the Open Advances table depends on the financial plan structure of the adopted programme linked to this declaration. Technical Assistance (M20) and Discontinued Measures (M113; M131;M341) are not subject to "open Advances" therefore these measures are not included in this table Budget codes structure The budget codes must have the following structure "05046001 MM RRR PP": - The first 8 digits are constant: "05046001". - The following 2 digits "MM" indicate the measure. - The next three digits "RRR" indicate the combination of articles used to establish the maximum EAFRD contribution rate: 1 digit for the 'Category of contribution rates (type of regions)/Discontinued. Measure'; 1 digit for the 'Derogations/Others allocations'; 1 digit for the applicability of articles 59(4)(d)1; 59(4)(g)1 and (24)(1) - The last 2 digits "PP" indicate the programme number |

1. Click on the Edit button  to start adding the required information.

to start adding the required information.

The edit Open Advances screen appears:

2. Enter the following:

Record the information in the appropriate field.

At the beginning of the current quarter = situation as declared in the last quarterly declaration of expenditure.

At the end of the current quarter = accumulated situation of open advances not cleared at the end of the quarter.

Difference = the variation between the two previous columns.

Click Update or cancel to save the data or cancel the action.

Remark | M20 and Discontinued Measures are not object to “Open Advances not cleared”, therefore these Measures must not be included in thin table. M20 of NRN is not subject to “Open Advances not cleared” therefore this section is not applicable for a DOE linked to a NRN Programme. |

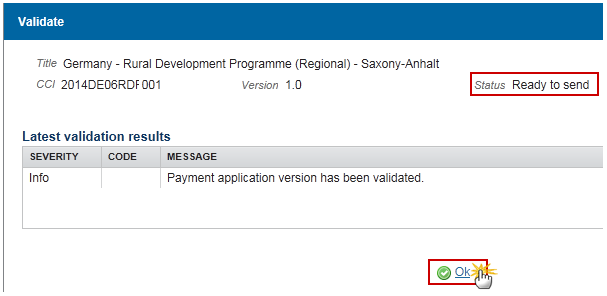

Validate the Quarterly Declaration of Expenditure (EAFRD)

1. Click on the Validate link to validate the Quarterly Declaration of Expenditure.

The system validates the following information:

Remark | An Error will block you from sending the Quarterly Declaration of Expenditure. The error(s) should be resolved and the Quarterly Declaration of Expenditure must be revalidated. Note that a Warning does not block you from sending the Quarterly Declaration of Expenditure. |

CODE | VALIDATION RULES | SEVERITY |

200 | The quarterly DOE version has been validated | INFO |

010 | Validate that all integral documents have at least one attachment with a length > 0 | ERROR |

202 | Validate that the DOE is linked to the last adopted Rural Development Programme Version (implicit in web). | ERROR |

209 | Validate that the Quarterly declaration of Expenditure per Measure only contains all EAFRD Measures once implemented (= having a Community Amount > 0) in one of the adopted RDP in or before the RDP Version in force at the last date of the quarter. -> implicit in web | ERROR |

212 | Validate that the Quarterly declaration of Expenditure per Measure only contains all Region Types present in the linked RDP Version (EAFRD) -> implicit in web | ERROR |

216 | Validate that the required Annual Implementation Report was once uploaded and sent to the Commission starting from 2016Q2. For YYYYQ2 and YYYYQ3, the required Annual Report is the one from the current year – 1, if for that year an EAFRD amount > 0 exists in the Plan. For YYYYQ4 and YYYYQ1, the required Annual Report is the one from the current year – 2, if for that year an EAFRD amount > 0 exists in the Plan (EAFRD) | WARNING |

218 | Validate that the negative EAFRD Recoveries/corrections per Measure in the Quarterly declaration of Expenditure do not exceed the sum of EAFRD contributions + EAFRD Recoveries/corrections over all previous declarations, Recoveries/corrections and Annual Clearance of Accounts Corrections included (EAFRD) | WARNING |

219 | Validate that the 'Public Expenditure incurred during the quarter' and the 'Public Expenditure incurred to financial instrument...' contain only positive amounts | ERROR |

220 | Validate that public adjustment are filled when EAFRD adjustments are filled (and vice-versa) | ERROR |

221 | Validate that public adjustment are filled when EAFRD adjustments are filled (and vice-versa) | ERROR |

222 | validate that Public financial adjustments (column 7') is different than 0 when EAFRD financial adjustments (column 7) is filled | WARNING |

223 | validate that public other adjustments (column 8') is different than 0 when EAFRD other adjustments (column 8) is filled | WARNING |

225 | Validate that the Bank account information are filled | ERROR |

228 | Validate that at least one Member State Official in Charge is filled | WARNING |

230 | Validate that the last AIR has been submitted to EC. Message: the AIR (0) has not been submitted to EC (art 36(3) point (c) of Reg (EU) 1306/2013) | WARNING |

240 | Validate that the Amount of the programme contribution paid to the financial instrument is <= 25% of the total amount of programme contributions committed to the financial instrument under the relevant funding agreement (art 41 (1) (a) Reg (EU) No 1303/2013). | WARNING |

242 | Validate that at least 85% (60% for the second application) of the amounts included in the previous (first for the second application) applications for interim payments have been spent as eligible expenditure within the meaning of points (a), (b) and (d) of Article 42 (1). | WARNING |

250 | Validate that the Paying Agency is still valid. The Paying Agency (Designated body) ‘{0}’ filled (code-name) is not valid anymore. | WARNING |

260 | Validate that expenditure are not declared under IACS Budget Codes from previous calendar years. | WARNING |

After all errors have been resolved the status of the Quarterly Declaration of Expenditure becomes 'Ready to send'.

An example of a validation window:

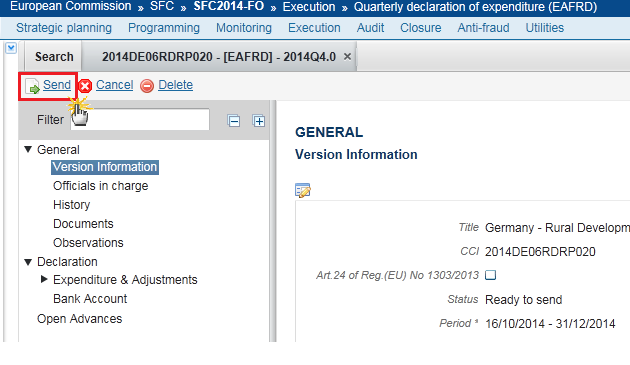

Send the Quarterly Declaration of Expenditure (EAFRD)

Remark | The Quarterly Declaration of Expenditure can only be sent once the Validation Errors have been removed and the status is 'Ready to Send'. It is a must to have the privilege to send the Quarterly Declaration of Expenditure. The "4 eyes principle" must be respected. Therefore, the user sending must be different from the user who last validated. |

1. Click on the Send link to send the Quarterly Declaration of Expenditure to the Commission or to an upper Node.

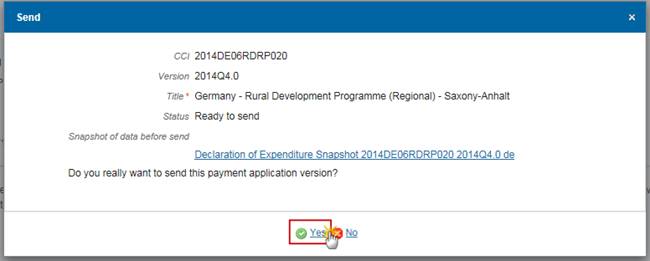

The system will ask you to confirm the send action:

2. Click on 'Yes' to confirm.

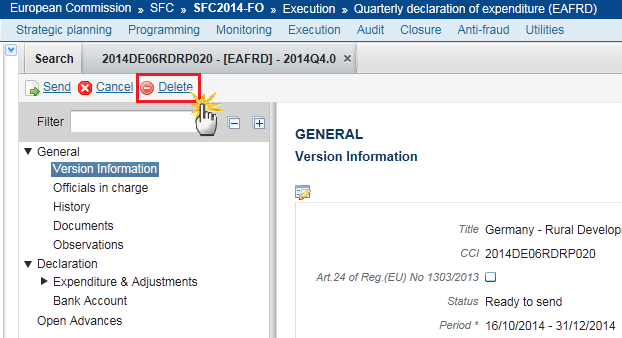

Delete the Quarterly Declaration of Expenditure (EAFRD)

Remark | A Quarterly Declaration of Expenditure can be deleted when the status is 'Open', 'Ready to send' or 'Returned for modification by MS', and has never been sent to the Commission before and has no sent documents attached. |

1. Click on the Delete link to remove the Quarterly Declaration of Expenditure from the system.

The system will ask you to confirm the delete action:

2. Click on 'Yes' to confirm or click on 'No' to return to the Declaration of Expenditure.

Cancel the Quarterly Declaration of Expenditure (EAFRD)

Remark | A Quarterly Declaration of Expenditure can be cancelled when the status is 'Open' or 'Ready to send' or 'Returned for modification by MS' before it reaches an 'Acceptance' and has documents sent to the Commission or has a previous working version 'Returned for Modification by the Commission'. |

1. Click on the Cancel link to remove the Quarterly Declaration of Expenditure from the system.

The system will ask you to confirm the cancel action:

2. Click on 'Yes' to confirm or click on 'No' to return to the Quarterly Declaration of Expenditure.

The Quarterly Declaration of Expenditure has been cancelled and its status was set to 'Cancelled'.

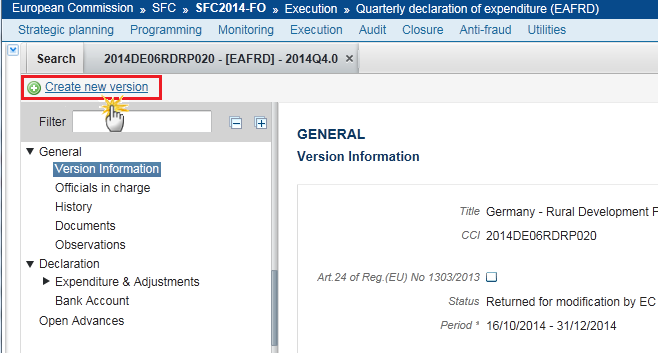

Create a New Version of a Quarterly Declaration of Expenditure (EAFRD)

Remark | A new version of the Quarterly Declaration of Expenditure can be created when the last version is in status 'Returned for modification by the Commission' or 'Cancelled'. |

1. Click on the Create new version link to create a new version of the Quarterly Declaration of Expenditure.

The system will ask you to confirm the creation of a new version:

2. Click on 'Yes' to confirm. Click on 'No' to return to the Quarterly Declaration of Expenditure.

Early Warning Notification

The submission of the first version of the DOE to EC must occur before the end of the corresponding Declaration Period. In case the DOE is returned for modification by EC, the new version can be resubmitted to EC even after the end of the corresponding Declaration Period.

A scheduling module will generate the following events which will be propagated by the notification module:

· At the first day of the Declaration Period an email will be sent: "Beginning of Declaration Period for YYYYQN"

· At the 20th day of the Declaration Period an email notification will be sent: "Declaration YYYYQN is missing"

· Every day between the 25th and the last day of the Declaration Period, an email notification will be sent to the Member State and it will say:

"Declaration YYYYQN is still missing and Declaration Period will be closed at dd/mm/yyyy".